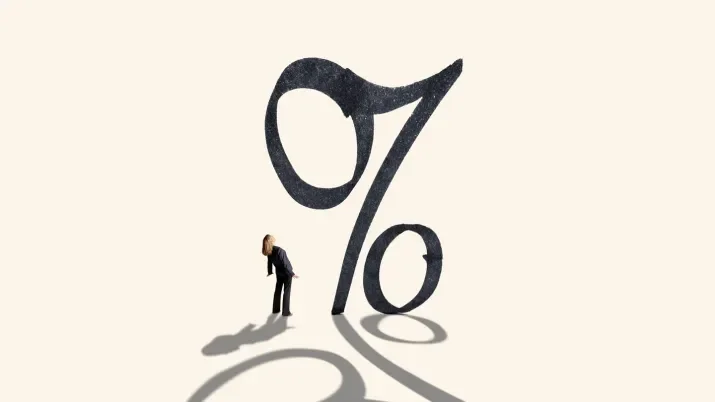

There is plenty more yield to come in floating rate bonds

Fixed rate bond yields may have climbed as markets priced in higher interest rates, but both existing and new investors in floating rate bonds have more to gain as central banks keep hiking, says Pauline Quirin