BoE Rate Hikes Would Be Music to ABS Ears

Inflation, tapering and rate hikes are dominating market discourse at the moment, but these issues have varying implications for different sectors of fixed income.

In recent weeks, rates have become a key source of risk again for bond investors. Ten-year Gilts yields as of this morning in London are around 1.08% having briefly flirted with 1.20% earlier this week, a level not seen since Q1 2019. Given they started the year at just 0.2%, this ‘risk-free’ asset would have lost investors over 7.5% this year – not exactly an attractive balance of risk and return. Staying out of Gilts won’t have helped that many people either, since long dated investment grade corporate bonds have followed a very similar pattern.

By contrast, ABS investors have ‘enjoyed’ a more boring 2021 to date, at least as far as rates are considered. As ABS transactions are primarily floating rate, they tend to track Sonia (for those less familiar with floating rate assets, Sonia is the replacement for the much maligned Libor, which is being discontinued at the end of 2021). Every UK ABS bond, whether that is RMBS, Auto ABS or CMBS, has a coupon with a fixed spread over Sonia. Sonia began the year at 0.05% and today it stands at 0.05%, having been as high as – you guessed it – 0.05%. So virtually all an ABS bondholder’s yield this year has come from credit spread, which ABS still tends to offer more of than most other credit assets as there is limited central bank involvement.

Whereas Libor had something of a forward-looking element as it refixed monthly or quarterly (depending on the payment frequency of a bond), this meant that as the market started pricing in rate hikes or cuts, Libor would reflect that. Sonia though is a daily rate with no forward-looking element; it compounds daily to calculate a bond’s coupon. Sonia effectively tracks the Bank of England’s base rate, which is currently at 0.1%, and in fact tends to only react to an actual policy change from the BoE.

Floating rate bonds thus have very short interest duration, as they generally refix their coupons every three months and therefore prices don’t tend to move when interest rates move up or down. But given the

recent BoE statements

and increasing UK inflation, we will be following its next policy meetings on November 4 and December 16 with much interest. There is plenty of speculation around whether the BoE might hike rates as early as November, and even more has been written about whether this inflation is transitory or not. What we can say is that we are clearly seeing supply chain and energy driven inflation, and the BoE is in a very difficult position as it will not want to risk a policy error. But let’s not forget that the BoE dropped rates from 0.75% right down to 0.1% at the start of the COVID-19 pandemic back in March 2020, having only managed to put through two hikes in 2017 and 2018. It has changed course sharply before.

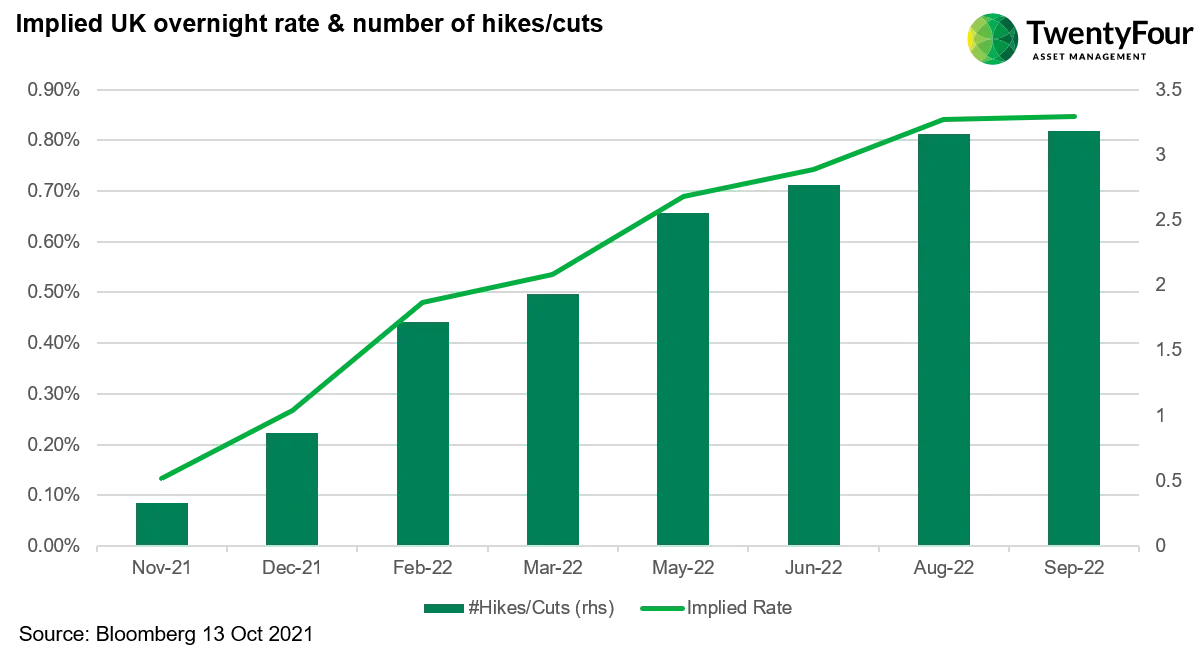

The rates market is certainly pricing in a number of hikes in the coming months, such that the implied base rate for the end of 2022 is now 1% (the Bloomberg data below only shows as far as September 2022 when the implied rate is 0.85%). Looking a year ahead is difficult for a floating rate investor, but two hikes are priced in by the end of Q1 2022 and a third in the summer.

This would ‘only’ bring us back to early 2020 levels, but ABS investors would welcome the additional income. The highest quality UK AAA Prime RMBS (one of the most liquid credit products out there) typically has a coupon of Sonia+0.25% for a three-year bond. That current income of 0.3% could in theory be 1.0% by next summer, three times as high. In contrast, a 100bp parallel shift in the curve for a fixed rate corporate bond would result in a multi-year lag to recoup that lost return through income alone. The potential for increased income and relative lack of rate driven volatility would suggest an allocation shift towards ABS from traditional corporate bond buyers, and we are starting to see signs of this already.

If UK inflation keeps rising and continues to challenge the transitory narrative as it has in the US (where CPI increased another 0.4% in September), the BoE may decide to act sooner rather than later. The implied rates and hike probabilities currently priced in could mean Christmas comes early for ABS investors this year.