TwentyFour Blog

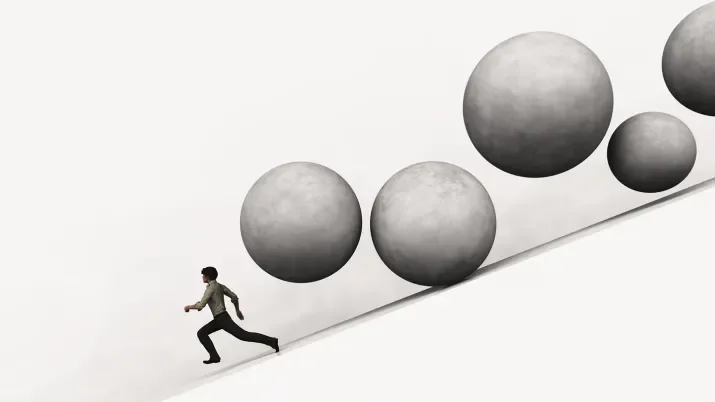

Should We Worry About Consumer Credit?

As the credit cycle develops across different economies, our asset allocation changes to reflect that, and if it looks to be at a mature stage in a specific country then our natural focus on credit quality becomes more important; we are always trying to avoid next year’s problem credits, whether in the financial, corporate or securitised markets.

Read more