Strong Technicals Dominate First Week's Trading

As most of our readers know, ABS is an asset class that lends itself well to detailed underwriting, from onsite due diligence through to cashflow and risk modelling. Specifically within the CLO sector, once we have reviewed the manager and the collateral, we focus on stress testing and sensitivity analysis. The hypothetical question “What if?” plays a fundamental role in assessing the resilience of the bonds we invest in to severe macro-economic shocks and general business cycles.

Every recession has a different driver; from the dot-com bubble in the early 2000s to the financial crisis 10 years ago, and there remain event driven tail risk and numerous views on what might potentially cause the next recession. We can ask questions like: What if Brexit is a hard exit? What if Draghi raises rates earlier than expected and affordability becomes an issue? What if there is a hard landing in the Chinese economy?

Although we don’t think that we are at the end of the cycle yet; we thought it would be useful to start the year with positive thinking and demonstrate the resilience of one of the largest and favoured sector within ABS. In this blog we’ll look at a recent CLO and consider how different scenarios could impact cash flows.

Structurally it’s a plain vanilla deal backed by 100% floating rate senior secured loans. It is fair to say that this transaction has low exposures to both Oil & Gas and the Retail sector, but we’re trying to explain the methodology. Current performance of the European leverage loan market is very strong, as a result of strong fundamentals and low rates. Prepayment rates have been around 25%-40% while the current outstanding default rate stands at 1.6% (in fact there are only a handful of CLOs outstanding with any defaults in the pool).

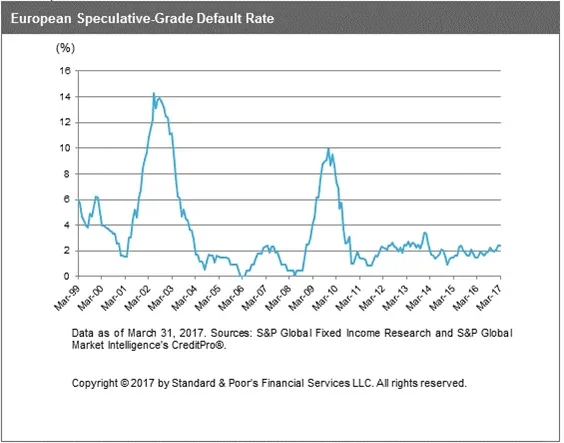

Away from a normal stress test (where we apply static default rates and loss severities in a large matrix) to see where a bond breaks, we are realistic that defaults are never static and come in waves, as can be seen in the graph below. So therefore we wanted to create a severe shock in the modelling, and one we consider is the average of the dot-com and financial crisis recessions (realising that the early 2000s was a very specific one); where CCC levels and defaults increased dramatically and recoveries on senior secured loans dropped to 50-60% from the typical 70-80%.

Source: S&P Leveraged Loan Index

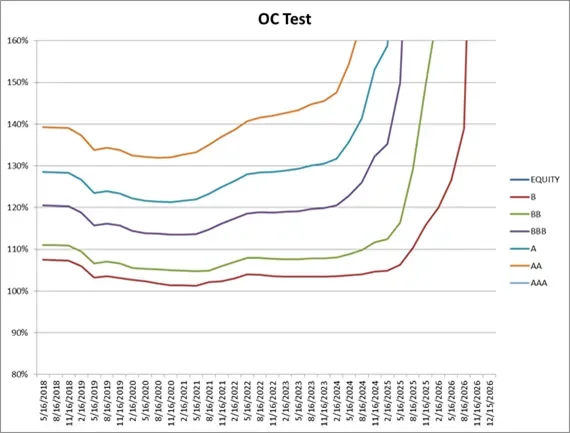

In our shock test we assumed that the economic shock will happen in 2 years’ time, when default levels increase to 12% and over time recover to a normalised level, with significantly elevated CCC levels, very low prepayment rates and 50% loss severities. Depending on the manager and the structure we assumed that the manager has the ability to add value to the deal by buying at higher spreads and lower cash prices. We also tested “multiples” of this scenario to see the sensitivity and to be able to compare CLOs.

The outcome we get is very interesting for the selected CLO, there is no principal loss on the rated notes over the life of the deal. That means that even in a recessionary environment an investor in the single B rated note for instance will get all his money back, together with all his coupons (which we see as being the best value in the credit markets at the moment). Given the average single B has around 7-8% of credit subordination, that is an impressive result. This is because the deal is doing what it is supposed to. Once Over Collateralisation (OC) Tests get breached, these tests show that on a risk adjusted basis there is enough credit support, and all cash flows to the equity/junior investors will be diverted to deleverage the structure until cured by firstly repaying the AAAs. In this specific scenario the stress is so severe that the interest on BB and B tranches is deferred for 0.5-1.5 years but fully repaid as the excess spread is enough to cover this. Needless to say the equity investor will take a big loss. Despite this BBB and higher rated bonds are unaffected from a cash flow point of view, but markets will likely be very volatile in this scenario!

Source: 24AM

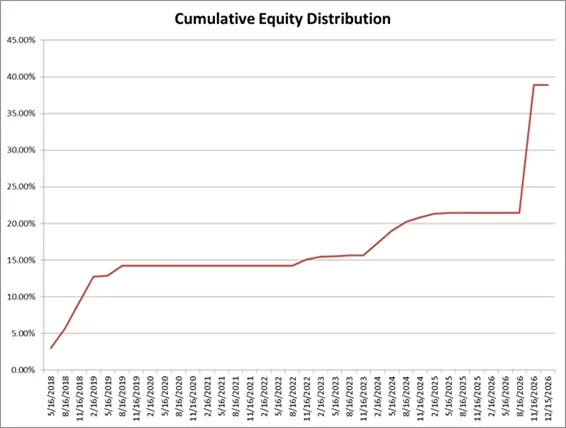

The graph below shows that equity investors will get paid until the OC test on the Single B class is breached, thereafter they don’t receive any payment until 2022 when defaults start decreasing (as even in this scenario there is some residual value left). The Cumulative Equity Distribution is 36%.

Source: 24AM

This is only one of the many deals in the market at the moment, and the resilience to severe events will be also driven by the performance of each CLO manager. Although this can’t be assessed in our stress test, here at TwentyFour we also spend a lot of time analysing CLO manager performance.

We are not in 2008-09 anymore, a lot of water has flowed under the bridge since, and this is by no means our base case scenario! Contrary to popular belief the pre-crisis vintages performed relatively well during the global financial crisis, with low credit losses compared to HY Credit. Stricter regulation, cleaner portfolios, lower leverage, higher coverage cushion, and prudent management should make this sector more resilient and an attractive investment.

Stay up to date with our latest blogs and market insights delivered direct to your inbox.