Tighter financial conditions might herald end to rate hikes

When the Federal Reserve was readying their last rate decision, on 22nd March, there was plenty of uncertainty from economists and strategies about whether they would actually hike, given the issues with US regional banks at the time, and the heightened uncertainty this was generating. The Fed held their nerve, due in part to the fact that they saw the bank issue as an idiosyncratic event, and tightened a further 25bps, taking the upper band of Fed Funds to 5%. However, since then, the release of key economic data suggests that we may now be at terminal rates.

While the Fed’s latest dot plots, released on 22nd March as well, suggests rates will go higher, we think there are a number of good arguments for the Fed to pause. The regional banking issue is very likely to result in stricter regulation and ultimately tighter financial conditions, although this is difficult to confirm until we see the next Senior Loan Officer Survey (SLOS), scheduled to be delivered in May. While deposit flows to the larger banks have increased, potentially giving them more lending power, regional banks make up ~40% of all lending, and are especially important to small and medium sized businesses. With smaller banks being forced to increase deposit rates to keep, and attract savers, and with the threat of more regulation hanging over them, we think it’s very likely the SLOS shows that they have already tightened standards to an important part of the US economy.

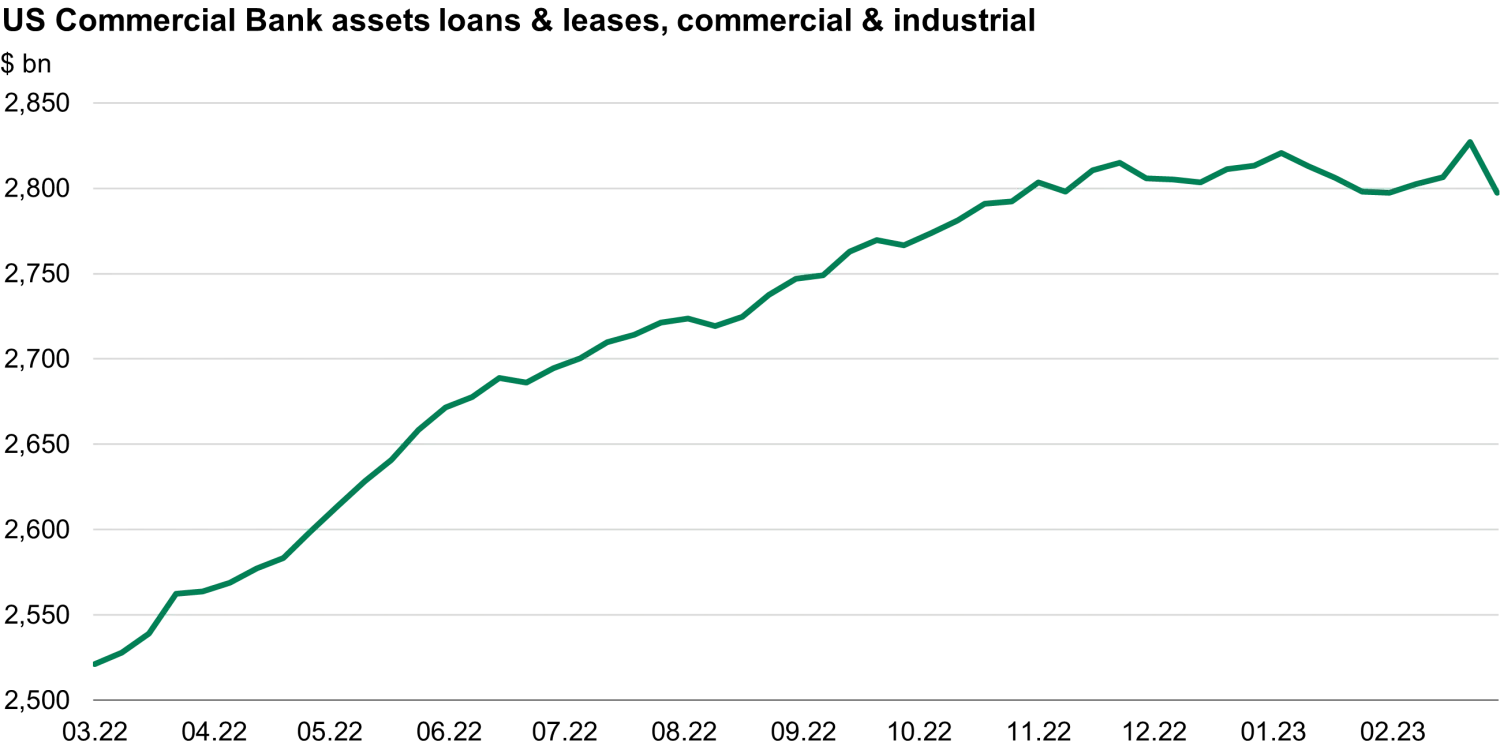

In addition, while the SLOS will contain important indicators, we have already seen that the total US Commercial Bank Assets Loans & Leases Commercial & Industrial outstanding is now beginning to fall. The plateauing of this index was highlighted in one of our recent blogs, and its relationship with tighter lending standards is well established (financial conditions are tightening - what comes next).

Source: Federal Reserve

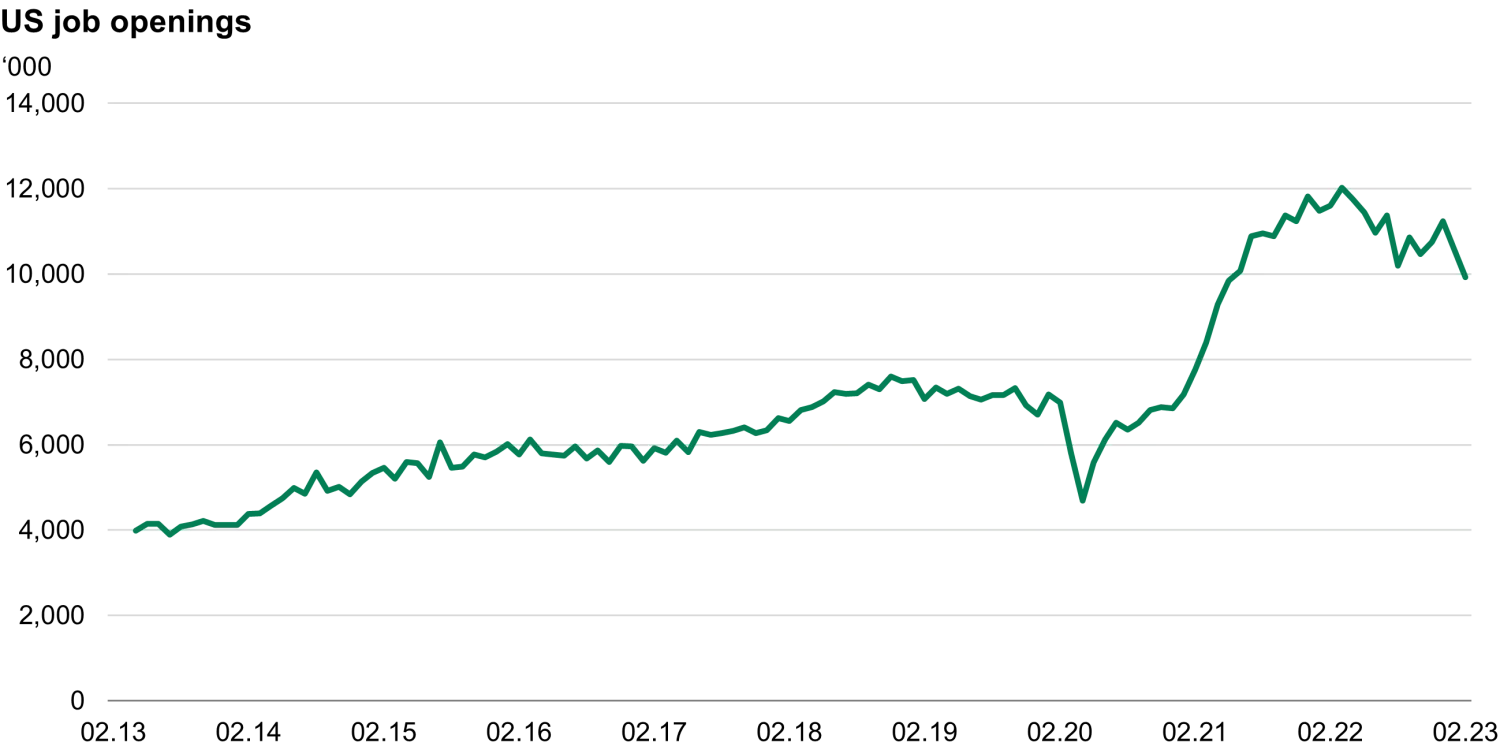

Of course, before the recent issues in the banking sector, what was driving the Fed was the fact that inflation, although falling, was still high and the US economy seemed to be taking the rate increases in its stride, as evidenced by the strong labour market. We got the first big hint yesterday that the jobs market may be weaking, when the US Job Openings and Labor Turnover (JOLTS) survey reported a big fall, coming in at 9.9m openings which was down 600K positions on the previous month and well below the 10.5m openings expected. This is also a backward looking data set, reporting openings for February, and given the volatility since then, we think it’s unlikely to have improved during March; particularly as there has been a further 25bp hike since that data point.

Source: Bureau of Labor Statistics

Amid this backdrop, fixed income spreads have also backed up since the start of February, making it more expensive for corporates to borrow; the spread on the US IG index is now 150bps, vs. 122 at the start of February, while the HY index has a spread of 490, over 80bps wider over the same period. In addition, while banks have recovered some of the lost ground, they are also funding at a higher level, with the US Bank & Broking index having a spread of 170bps, vs. 144bps in February.

Although we think the Fed officials are likely to stick to their message that rates will go higher, as Cleveland President, Loretta Mester, reiterated yesterday, the median expectations on the last dot plot is just one hike away and Treasury yields are once again moving lower, with the 10yr maturity yield now at 3.36%. This may be tested when nonfarm payroll and unemployment date is published on Friday, with inflation data coming out next week. In addition, markets are also, once again, pricing in rate cuts this year, with year-end 2023 base rates expected to be back to 4.25% in the US. This may prove to be too optimistic in our view (it’s barely a month ago that the implied base rate for year-end was at 5.75%!) and it is certainly not our base case, however for fixed income investors the end to rate hikes seems to be tantalisingly close, and correlations have already returned – all of which is very welcome news.