This is as good as it gets for linkers

Against a backdrop of 4.20% year-on-year UK consumer price inflation (CPI), if you got your timing right, linkers (inflation-linked UK government bonds) will certainly have outperformed conventional Gilts by some margin. For example, the year-to-date total return on the 10-year UK linker is 10.0% versus -2.8% on the equivalent conventional Gilt. However, this outperformance is unlikely to continue from here.

We have warned about the challenges of using linkers as an inflation hedge on a number of occasions. The linkers market is more complex and technical than conventional government bonds, especially in the UK, where many buyers must hold them against long-dated pension liabilities. As a result, linkers tend to trade in a more volatile fashion, and often disconnected from fundamentals. Linker prices are incredibly sensitive to changes in real rates (nominal interest rates minus the rate of expected inflation), and thus inflation expectations in particular.

To summarise the mechanics of linkers, the principal value of the bond is adjusted for inflation, and the coupons are a fixed percentage of the inflation-adjusted principal. Therefore, in an inflationary environment, the monetary value of each coupon payment increases. As a hypothetical example, consider a £1,000 10-year inflation-linked Gilt with a 2% semi-annual coupon. If annual inflation is 4% over those 10 years, the principal will increase to account for this. Therefore at maturity the principal value of the bond will be £1,486, and the final (semi-annual) coupon payment will be 1% of £1,486.

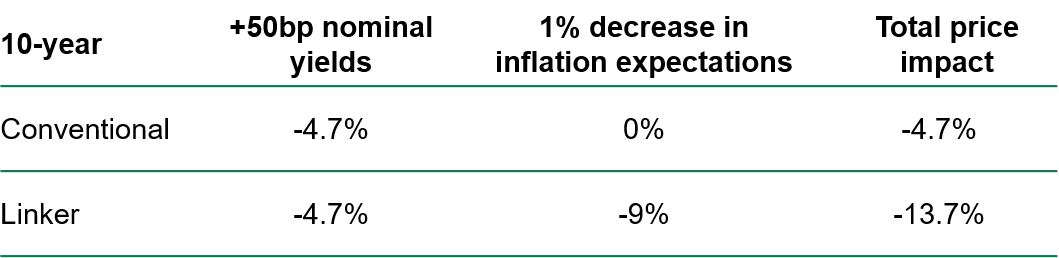

The price of a linker tends to be inversely related to real yields, and directly related to inflation expectations. Given we have witnessed incredibly low real yields and high inflation expectations over the past 12 months, linkers have performed very well. However, with the Bank of England pondering an imminent rate hike to get ‘ahead’ of inflation, higher real rates could hurt both conventional Gilts and linkers. More importantly, the decrease in inflation expectations which typically follows a tightening in financial conditions will likely cause linkers to fall more than conventional Gilts. For example, imagine the Bank of England credibly signals to the market that it is entering a hawkish phase with multiple rate hikes to follow. The expectation of higher base rates should raise the nominal yield demanded by investors on both Gilts and linkers, shifting their prices lower. However, as our chart below demonstrates, if inflation expectations fall as a result of the BoE tightening, the subsequent rise in real yields is a double whammy that only impacts linkers. Indeed, any factor which lowers inflation expectations, such as investors believing inflation is transitory, will tend to hurt a linker more than a conventional bond.

Chart title: Potential reaction to more hawkish BoE

At this stage in the cycle, linkers appear more vulnerable than conventional risk-free assets, and investors should be mindful that their intended hedge against inflation may be working against them when needed most. Ultimately, we think minimising duration by focusing on shorter dated bonds or floating rate ABS, and more generally offsetting upward moves in rates with higher spread products, offers better protection against inflation than linkers.