Tesco Bonds: Time to Hit the Checkout?

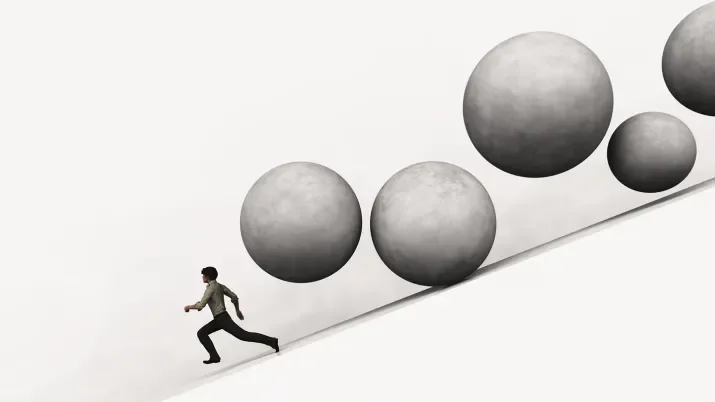

In January 2015, after years of market share erosion and leverage increases, Tesco bonds were downgraded to junk status by Moody’s and S&P, forcing all of Tesco’s debt stack out of IG corporate bond indices in the process.