If rates were to rise like 1994, would IG credit produce a positive return?

1994 was my first full year in the markets, and what a baptism of fire it was. The Federal Reserve raised rates by 250bps, 10Yr Treasuries saw yields rise by more than 200bps causing total returns to fall by more than 8%, and US IG credit was down 3.3% as a result. (All figures using BAML indices).

Two hundred and fifty basis points in one year - it is almost hard to conceive of central banks taking such hawkish action on rates in a single year nowadays – for example the current Fed has been hiking at a quarter of 1994’s pace, taking twice as long to raise rates by half that amount for the current cycle.

Whilst we are not expecting aggressive rates rises from any central bank over the next few years, investors have become rightly concerned about the turn in the global rates cycle now that the Fed have raised 5 times, the MPC once, and ECB tapering is now on the brink of happening. So, what happens to credit returns in years when interest rates rise significantly?

Using BAML data for 560 US credit indices from 1991 to 2017 we back tested returns, to find out where the highest Sharpe Ratios (risk-adjusted returns) would be found through the cycle. What we found was that the very best risk-adjusted returns over this long time frame were to be found in a BBB-focussed, short-dated strategy, which was predominantly invested in 1-3yr and 3-5yr maturity securities.

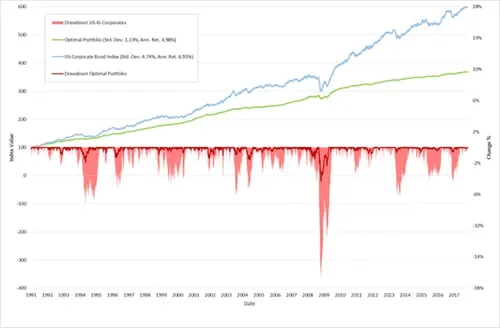

Comparing the returns, and drawdowns, of this short-dated (optimal, but passive portfolio, called optimal because it achieved the highest Sharpe Ratio) versus the broader US Corporate Bond index shows the following:

Chart 1: US credit back test using 560 BAML indices, from 1991 to 2017.

Source: TwentyFour, BAML

The first observation is that the short dated optimal portfolio (green line) achieved 72% of the return of the broader US Corporate Bond index (blue line), achieving an annualised 4.98% vs 6.91% respectively over the whole period. Turning to 1994, the first meaningful observation is that credit losses in the longer maturity benchmark (pink area) were not nearly as severe as those suffered in 2008, but despite that the longer maturity benchmark still had more than a year in negative territory through 1994 and into early 1995. Compare that to the short dated optimal portfolio (dark red line). You can see losses peaked at -1.88% during 1994, but the optimal portfolio also had a return profile that became positive far more quickly. In fact losses were reversed quickly enough that the calendar year 1994 actually resulted in a positive return of +1.75%. This compares to -3.3% for the broad index, so the optimal portfolio outperformed broad credit by more than 5% when rates rose by 250bps. Whilst not a stellar return, it was decently positive in a year that saw the largest rate rise seen from the end of the seventies up to the current day.

So to answer the question, if 1994 was repeated, can IG credit achieve a positive return? Yes, we think so, but only when focussed on short dated, high breakeven securities. The difference between now and 1994 is of course that starting yields are significantly lower, so the prospects of longer dated credit achieving a positive return are lower than they were in 1994, and in 1994 longer dated credit returned -3.3%.

But the prospects of a central bank raising rates by 250bps in a single year are also significantly lower.

So, ultimately we think that IG credit, if the mandate is flexible can still generate positive returns if rates rise unexpectedly, because yield curve roll down and carry are powerful forces offsetting capital losses. As long as duration is kept low.