Trump dunks on the NZBA with Wall Street exodus

The Net Zero Banking Alliance (NZBA) has been the flagship climate initiative for banks to advertise their commitment to aligning their investment and lending portfolios with net-zero targets by 2050 or sooner.

However, in recent weeks the NZBA has been hit with the withdrawal of all its major Wall Street banks. The departures began in December with Wells Fargo and Goldman Sachs, followed closely by Morgan Stanley, Citigroup and Bank of America. JPMorgan completed the exodus on January 7.

For ESG-aware fixed income investors, the question is whether this mass withdrawal is merely a gesture towards the incoming Trump administration’s approach to climate issues, or a more serious threat to the banks’ long-term sustainability commitments.

A bit of background

Established in 2021, the NZBA’s roster of 43 founding members included major Wall Street banks such as Morgan Stanley, Citigroup, Bank of America, Goldman Sachs and Wells Fargo. Members are required to set interim targets for 2030 alongside their 2050 goals, ensuring alignment with the latest climate science. They must also annually disclose absolute emissions, emissions intensity, and progress against a transition strategy that includes proposed actions and sector-specific climate policies.

For investors, alliances like the NZBA are useful tools for ensuring banks translate their climate commitments into measurable actions. By requiring management teams to set credible, science-based targets and report progress annually, these initiatives enhance transparency and build investor confidence. They also push banks to align their lending policies with long-term sustainability goals, helping to mitigate climate-related financial risks. For non-financial firms the Science-Based Targets initiative (SBTi) plays a similar role, encouraging companies to adopt rigorous emissions reduction strategies. Together, these frameworks provide valuable guidance for driving accountability and advancing collective progress toward broader climate objectives.

Banks toe Trump’s line

While none of the exiting banks has explicitly cited the incoming Trump administration’s approach to climate matters as a reason for leaving the NZBA, this is clearly the primary factor driving their decision. Trump has made clear his plans to withdraw from the Paris Agreement again, as he did during his previous term, making the banks’ exits seem like a pre-emptive move to avoid being in Trump’s firing line. Additionally, Republican lawmakers have suggested that NZBA membership, if it resulted in reduced financing for fossil fuel companies, could potentially violate antitrust laws. While these allegations have yet to be proven, the risk of litigation likely motivated US banks to remove the target on their backs by distancing themselves from the Alliance.

So far, none of the banks that have left the NZBA have cited a specific reason for their departure, though all maintain their commitment to the net-zero targets set under their membership. This suggests that aside from shedding the NZBA label, there has been little change at this juncture. Considering the above, in our view these departures do not signal Wall Street’s abandonment of the green agenda or a shift from their net-zero goals, but rather a preference not to publicly advertise their commitment through the NZBA.

Significant progress on fossil fuel financing

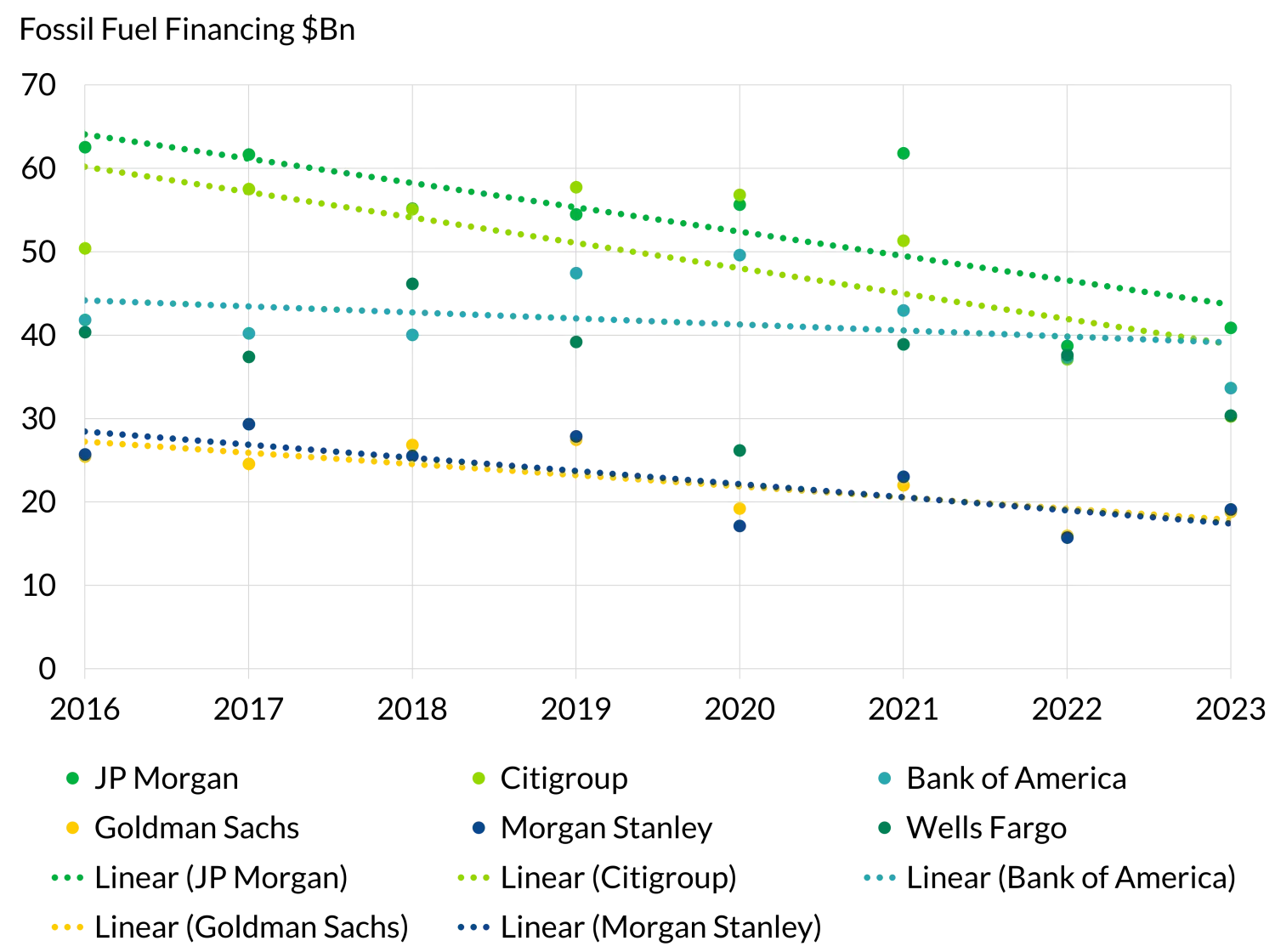

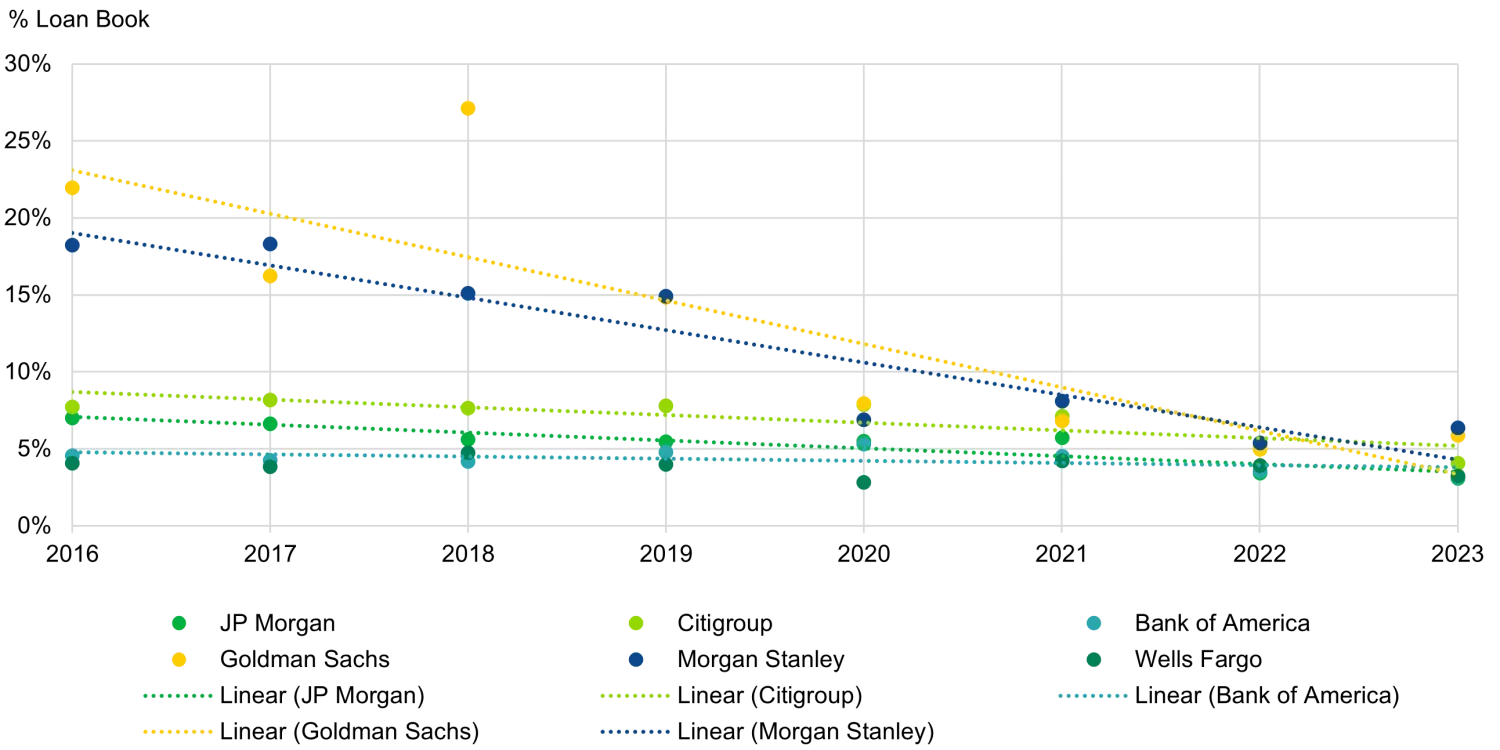

When we look at historical financing data it reveals a consistent trend among the departing banks. Exhibit 1 shows the absolute volume of fossil fuel financing by each bank, while in Exhibit 2 we have normalised the data against the size of each bank's lending book to more effectively demonstrate how their proportion of fossil fuel financing has shifted relative to overall lending.

Exhibit 1: Wall Street fossil fuel financing – absolute volume

Source: Banking on Climate Chaos report, May 2024.

Exhibit 2: Wall Street fossil fuel financing – normalised volume

Source: Banking on Climate Chaos report, Bloomberg, TwentyFour, January 2025

As the charts show, since 2016 each of the departing banks has reduced fossil fuel financing both in absolute terms and relative to overall lending. The group’s progress has been significant, with a 30% drop in absolute volume and a 44% drop in normalised volume (also, fossil fuel financing accounted for 4% of lending in 2023 versus 7% in 2016). This progress isn’t solely attributable to the banks' NZBA membership; it also reflects investor and political pressure pushing them to transition their activities toward alignment with 2050 net-zero targets.

While Wall Street may have scaled back fossil fuel financing in recent years, this has not resulted in a funding gap for the sector as Asian banks and private credit have stepped in. Even if Trump’s policies to boost fossil fuels are enacted, the sector is unlikely to face a major funding shortfall.

Long-term goals look relatively safe

It is important to note that the sustainability commitments these banks have made are inherently long-term, so it is unclear whether there will be a significant shift in strategy based on policies that can easily be changed at the end of a four-year presidential term. Time will tell how this evolves, but Trump’s “drill, baby, drill” rhetoric signals his strong support for the oil and gas sector. While it is possible that banks may increase fossil fuel financing to align with Trump’s policies, our base case wouldn’t see it return to a 2016-18 level.

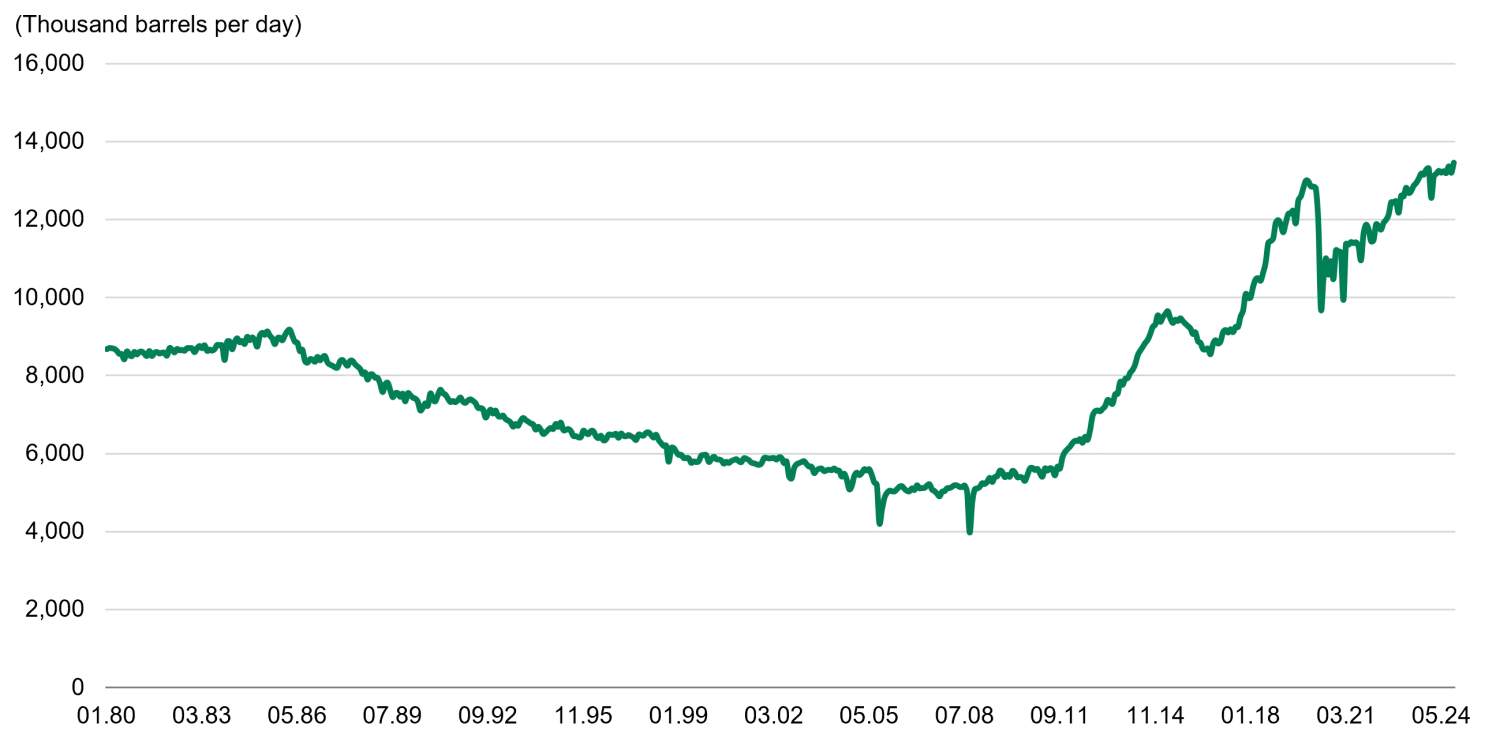

It is also worth noting that US oil production has reached record highs under the Biden administration despite the outgoing president’s promises to reduce fossil fuel reliance (see Exhibit 3). This development has not received much attention, partly due to limited support from his voter base, suggesting that Biden’s approach has been less restrictive than initially expected.

Exhibit 3: US production of crude oil

Source: US Energy Information Administration, September 2024.

Trump clearly has ambitions to further increase US oil production, and while some producers can somewhat ramp up capacity, any significant rise will require substantial investment from major oil companies. Given the potentially short (four-year) tenure of his presidency, these companies may be hesitant to commit this capital, wary of the political risk and policy shifts that could occur if leadership changes.

Beyond Trump’s stance on fossil fuels, many are curious about his approach to the renewables sector. Biden’s 2022 Inflation Reduction Act (IRA) has strongly supported renewable energy projects – particularly batteries, electric vehicles, wind and solar – through tax credits that have made previously uneconomical investments viable. This has bolstered US economic growth and job creation, with a large share of new projects occurring in Republican states. According to CNN, nearly 78% of the $350bn in clean energy investments announced under the IRA has gone to Republican states. For instance, Bloomberg reports Hyundai’s EV battery plant in Ellabell, Georgia, could create up to 8,100 jobs, equivalent to 39% of the county’s workforce. Similarly, Ford’s EV plant in Stanton, Tennessee, is expected to add 6,000 jobs, representing 74% of the county’s workforce. Given the significant economic benefits for “red” states, Trump is likely to consider how policy changes could impact his voter base, especially as many elected Republican officials who opposed the IRA are now celebrating its success.

ESG gap between US and Europe widening

Despite the Wall Street exodus, the NZBA still boasts 141 member banks from 44 countries, now with a notable skew towards Europe. Collectively these banks manage $61tr in assets, highlighting the significant influence they still wield. The withdrawal of US banks from the Alliance has not spread to Europe, and it is unlikely to do so given the region’s markedly different political and regulatory landscape – we see European banks still proudly advertising their membership. The US has always been in Europe’s shadow when it comes to ESG, and with Trump’s anticipated actions, the gap between the two regions is only likely to widen.

The wave of US banks leaving the NZBA is a clear signal that sustainability commitments are facing new challenges from the incoming Trump administration. In our view, as it stands this doesn’t mean an abandonment of net-zero targets but potentially a more lenient shift in how these banks approach fossil fuel financing. For investors, the key will be to carefully track these banks' actions and assess how they align with their stated climate goals. As Trump’s policies continue to unfold, we may see further shifts in the energy landscape, but it’s unlikely to mark a complete reversal of the green agenda given the meaningful economic benefits in red states – at least for now. Ultimately, Trump’s approach may involve a dual strategy, supporting both renewables and fossil fuels which will complement the surging energy demand from AI. Time will tell how these dynamics evolve, but for investors, staying attuned to these developments will be crucial in navigating the complexities of US banking and sustainability moving forward.