Fed rates held: Goldilocks is in the building

All eyes were on the Federal Reserve last night and as usual it was the detail in the statement and Q&A that proved to be the most interesting, rather than the rate decision itself.

As expected, base rates were held at 5.5% (upper bound), however, the Fed signalled that they were ready to hike again this year, if the data remained strong, and according to the DOT plots, 12 of the 19 members think they will go again. What is more interesting is the changes to the DOTs for 2024, with two of the previous four expected cuts being removed, and the base rate now expected to be at 5.25% (upper bound) at the end of 2024. Target rates for 2025 and 2026 also went higher, but given the volatility of the data, the usefulness of these numbers is limited.

Unsurprisingly, treasury yields moved higher on the statement, having initially rallied, as Jerome Powell stressed that rates would be higher for even longer. However, he also stressed that the Fed needed to “proceed carefully” and at times seemed to contradict himself, as he seemed almost reluctant to fully buy into the economic forecast that supported this higher-for-longer message.

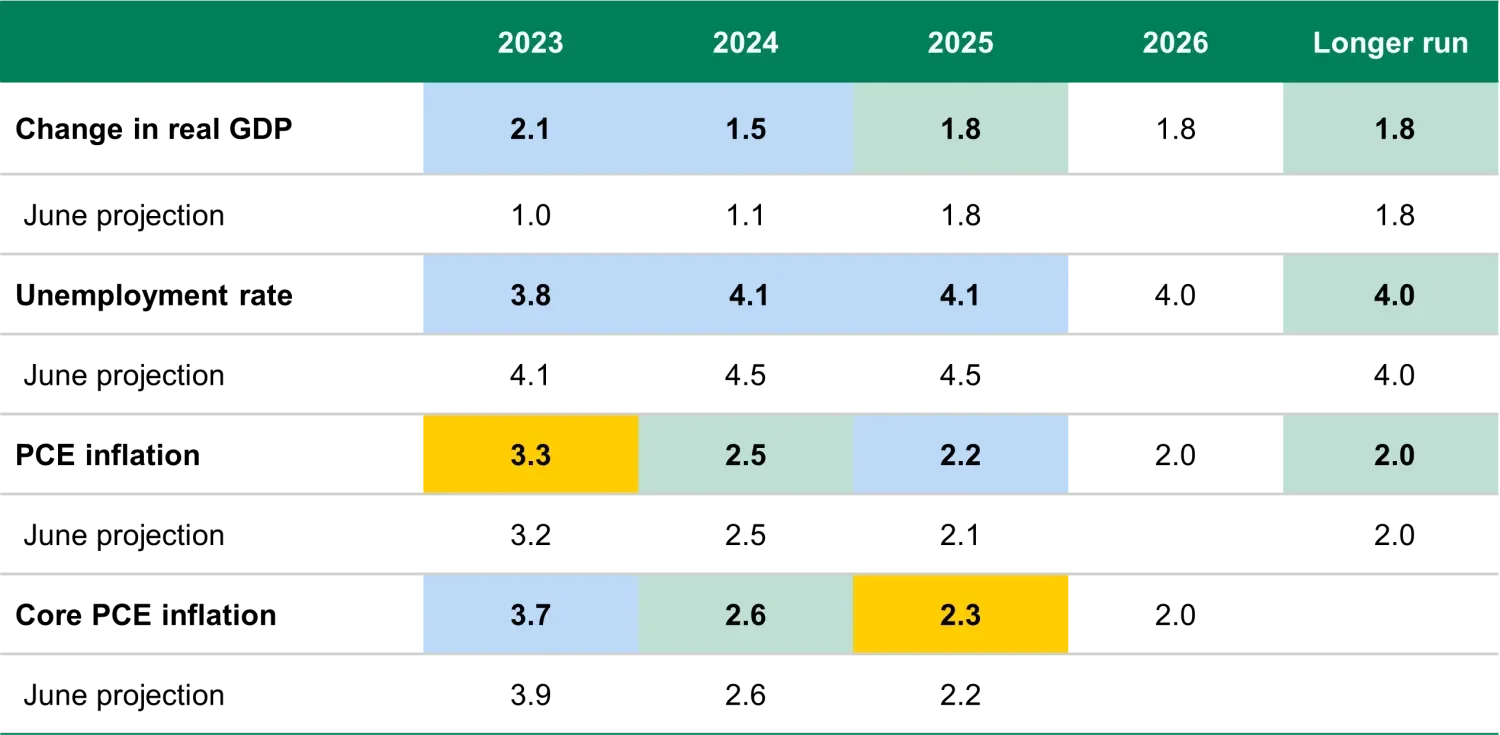

It is also the optimism of the staff forecasts that we are struggling with, so we can understand his hesitation. As can be seen in the table below, in comparison to the June forecasts, Real GDP is now expected to be higher, the unemployment rate is expected to be lower, and inflation is expected to continue towards target.

Economic Projections of the Federal Reserve Board

Source: FOMC Projections

With forecasts like these, it really isn’t any surprise that the DOTs moved as they did. On the face of it, the forecasts don’t seem to leave much room for the possibility of a lag between monetary policy and economic data. It also gives the impression that the hiking policy is a precision instrument to tackle inflation, leaving the rest of the economy unscathed. If the Fed accomplishes this, it will be a remarkable achievement.

Nevertheless, optimistic or not, the path of least resistance is for treasury yields to go higher, and it will probably take weaker economic numbers, contradicting these forecasts, to take yields lower again. In addition, with the Fed continuing its balance sheet reduction and with Japan and China taking their holdings lower, treasury yields are lacking technical support.

For those who believe that a harder landing, or at least less of a softer one, is in store, what was said last night probably won’t alter their thinking, and these higher yields offer protection with income for portfolios.

In fairness to Jerome Powell and his colleagues, the US economy has been remarkably resilient in the face of aggressive hikes, and Powell has emphasised that they are data dependant, so the actual path of rates could differ significantly to what the DOTs predict currently. For now, though, while treasury yields aren’t helping, credit looks attractive based on the rosy economic forecasts.