Discipline crucial amid surge in bond supply

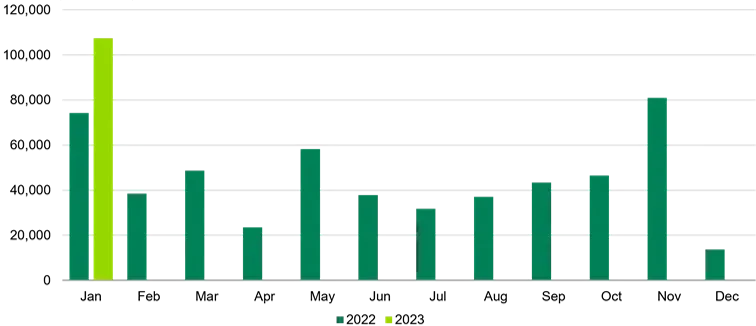

After a lacklustre 2022 for primary markets, 2023 started with a bang.

January was a record month for European bond issuance with nearly €110bn of new supply printed across financials and corporates. That figure far exceeds any month last year and is almost 20% of the total for the whole of 2022.

European Corporates and Financials supply

Issuance (EUR millions)

Source: TwentyFour, Bloomberg, 31 January 2023

Financials issuance accounted for around 60% of the January haul with nearly €65bn issued by banks and insurers across the capital stack, a 70% increase on the previous year. The bulk of this supply has been driven by senior issuance, which at around €53bn was almost double the €29bn printed the previous January.

Corporate bond issuance has increased by a more modest 5% year-on-year, though this isn’t particularly surprising. Banks tend to have more regular funding needs, whereas companies can shift their investment and capital needs with the economic cycle and thus are more likely to shy away from today’s higher interest rate environment, especially given the amount of prudent front-loading of issuance we saw through 2020 and 2021.

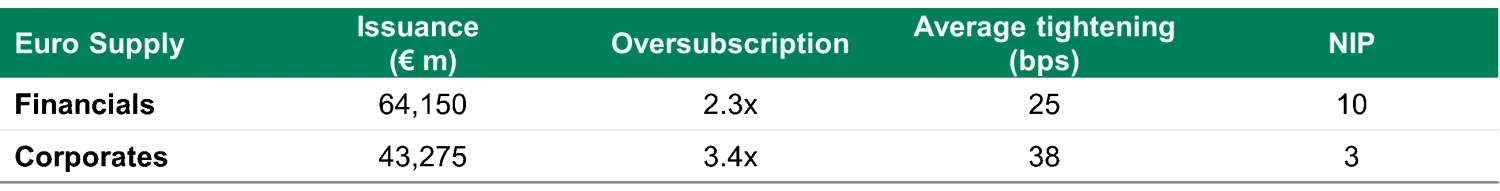

As the chart below demonstrates this wave of supply has been met with strong investor demand, with issuers able to tighten pricing from initial price thoughts (IPTs) and pay a relatively slim new issue premium (NIP).

Source: TwentyFour, Bloomberg, 31 January 2023

Based on subscription levels January’s €110bn of issuance has been met with over €260bn worth of demand, reflecting the sheer amount of cash that remains on the sidelines. Financials enjoyed an average oversubscription of 2.3x, while corporate demand was even healthier at 3.4x, probably reflecting the lack of any meaningful increase in supply and limited liquidity in secondary. Notably, a number of deals priced either at or inside what we saw as fair value.

Supply in higher beta parts of the market has also been well received, particularly in corporate hybrids where the level of demand has been a key driver behind the lack of NIP in corporate issuance. Having been one of the worst performers in a poor 2022 for credit in general, corporate hybrids (except perhaps for REITs issuers) look to have shrugged off the extension fears which dominated the asset class last year and the demand here has been the clear standout year-to-date.

January’s corporate hybrid issuance surpassed the total for the last three quarters of 2022 combined, and with an average oversubscription level of 4.6x. Of the seven deals printed in January we saw two priced at fair value and the remainder priced 25-50bp inside existing credit curves. Most notably, Spanish energy giant Iberdrola tightened its deal 87.5bp from IPTs and priced 50bp inside what we saw as fair value.

So what is driving the demand across fixed income, and why so much issuance in January?

Fund flows have been very supportive, with European credit funds reporting their highest weekly inflows since June 2020 throughout January. Secondary liquidity has also been poor and therefore primary issuance has been a welcome home for investor cash. However, a key driver of demand has been yield-hungry pension and insurance funds looking to lock in this wave of high coupon, investment grade issuance, the like of which has obviously been scarce in recent years. The long term investment horizons of these funds mean they are better able to tolerate the potential mark-to-market volatility that will be concerning many investors in a year where the macro backdrop remains challenging.

January always tends to be a busy month in primary markets, with issuers keen to make a start on their funding plans for the year and investors often having fresh asset allocation plans to fulfil. This year was always likely to see an extra surge given the low issuance volumes seen across 2022 – companies have to issue eventually – but issuers are also taking advantage of the open primary market while the macro backdrop remains constructive (the experience of 2022 proved how quickly this can shift).

However, one important factor that is often overlooked is government bond supply. In Europe net issuance is expect to be more than €500bn this year, a record level which will no longer be propped up by central bank buying. This is an overhang syndicate desks will have been warning issuers about and encouraging them to get funding done early; with cash rates finally offering attractive returns again, credit will need to compete with the glut of risk-free supply in 2023.

In this market, it is important for investors to remain disciplined rather than being swept into large deals because they appear popular. Oversubscribed deals look well supported, but repeatedly this year we have seen syndicate desks use this as an excuse to tighten pricing and erode value, a move which typically leads to lacklustre secondary performance.

The macro backdrop is still uncertain but we’ll hear more on that front from the central banks this week. In primary we think investors need to stay selective, stick to favoured names and avoid the Fear of Missing Out. Markets have digested this bout of supply well, but as we head into 4Q22 earnings season the pause in the primary onslaught will be a welcome opportunity for secondary markets to take stock of what’s to come.