Having your cake and eating it

At one recent investor meeting we received the following comment: “The yield is great, but my clients need to eat, what does it pay?”

With yields having risen sharply across 2022 as central banks hiked repeatedly in a bid to tame inflation, this is a question that will likely be playing on many investors’ minds as they evaluate what appears to be an attractive entry point for fixed income.

It will not be news to anyone that yields have moved a long way, but until primary issuance picks up dramatically the cash generation from various corporate bond indices will remain very low. Thanks to the magic of QE, companies have been able to finance their funding needs with long maturities at very low coupons in recent years, meaning there is relatively little outstanding stock of high quality bonds paying high coupons. Investors that need current income (especially because of inflation) are probably more likely to look at high yield bonds and equity for their income, though that is clearly not without risk.

Income investors in sterling credit are better off than euro investors in this respect as coupons are generally higher in the former, but the sterling market also carries a lot more duration than its euro equivalent. For a duration of almost seven years sterling investors get a coupon marginally better than the risk-free rate, while euro investors get an average coupon of just 1.7% versus the European Central Bank rate of 2%.

*Yield in local currency

Source: TwentyFour, ICE BofA Indices, 23 January 2023

Keep in mind that both the Bank of England and the ECB have policy meetings on February 2 and the current consensus is for both to hike rates by another 0.5%, which would mean both the sterling and euro markets paying lower average coupons than the risk-free rate. Since corporate bonds are predominantly fixed rate, it will take new issuance in the primary market for average coupons to increase.

Where can investors go to find at least 5-6% of proper cash-in-your-pocket income? One alternative is investing in high yield bonds, but with coupons of 5.3% on the UK HY index and just 3.6% on the European HY index for BB- rated risk, that doesn’t look particularly helpful (though overall yields are certainly more attractive). With dividend yields of 3.5% on the UK’s FTSE 100 index and just 2.5% on Germany’s DAX, income hungry investors can’t pay the bills with equities either (there are of course riskier companies that pay out more generous dividends, but we are looking for low risk income here). Traditionally pension and retail investors could have used (commercial) real estate for a stable (and somewhat inflation-linked) income, but with that market undergoing significant challenges and valuations at risk of a substantial correction it’s not an ideal option and certainly not a liquid one.

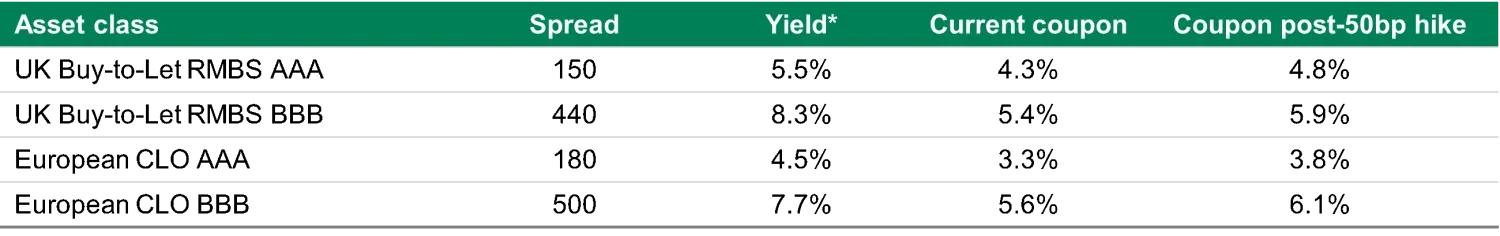

The best alternative in our view would be floating rate bonds, whose coupons adjust higher in line with every central bank rate hike. While there is a modicum of floating rate bank issuance, asset-backed securities (ABS) is essentially the only large-scale, high quality floating rate bond market in Europe. There is no arguing that in all bond markets yields are higher than actual coupons, but at least in ABS and CLOs investors can get a decent income from day one. In sterling we prefer UK RMBS and short dated investment grade Auto ABS, while in euro we prefer CLOs and Dutch RMBS. In the table below we can see that current yields already look attractive at around 5% for AAA and 8% for BBB risk, but the current actual income that investors receive via coupons (typically paid quarterly) is far ahead of what’s achievable in corporate bond indices.

*Yield in local currency

Source: TwentyFour, Bloomberg, 23 January 2023

It is worth noting that the current coupon figures in the table above are based on ABS and CLO deals issued in 2021 and 2022 (which still trade at discounts), so they will instantly increase if the BoE and ECB hike as expected next week and will do so again in line with any further hikes.

Just a year ago base rates were still so low that most investors would have considered investment grade ABS and CLOs simply a low volatility and liquidity product rather than an income product, but thanks to the seismic shift in the monetary policy environment in the last 12 months, these floating rate markets are now offering investors high regular income with the additional bonus of attractive yields.