Let it go, turn away and slam the door

The UK consumer is facing a tough few quarters. Inflation will continue to be at elevated levels and the economy is likely to underperform the rest of the G7. Growth projections globally have been revised upwards since the start of the year, and, although the UK has been no exception, its upwardly revised numbers are still below zero for 2023. Personal consumption typically accounts for close to two-thirds of aggregate demand in developed economies, so it follows that a grim picture for the consumer translates quite easily into a grim picture for the economy as a whole.

One factor that partially explains the underperformance of the UK consumer in terms of growth versus other regions such as the US is the savings ratio, which is defined as the amount of money households have available to save as a percentage of their gross disposable income, plus their pension accumulations. Both in the US and the UK the consumer received several rounds of much-needed government support during the pandemic, at a time when spending it was not easy. This resulted in a sharp rise in savings for a number of months. As expected, once the economy reopened and extraordinary fiscal transfers ceased, the savings ratio receded to more normalised levels. In fact, it was not farfetched to think these ratios would ultimately fall below their pre-pandemic levels, since consumers could afford to spend more of their monthly income safe in the knowledge that their balance sheets were underpinned by a larger pool of savings. While this is actually happening in the US this is not exactly the case in the UK as the graph below shows.

Source: Bloomberg, US Bureau of Economic Analysis, UK Office for National Statistics, 13 February 2023

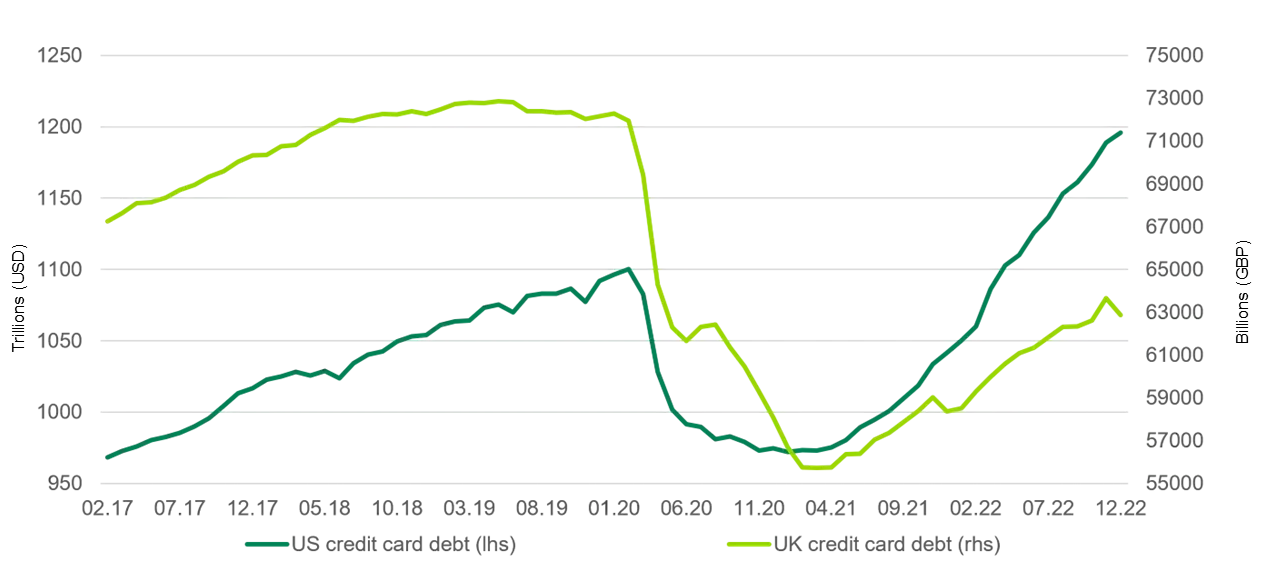

The difference in experience between the two economies here is significant, and our reading is that UK consumers are being far more cautious than their US counterparts when compared to their own histories. This is confirmed by a similar divergence in credit card debt; as the chart below shows, US consumers blew past their pre-pandemic mark months ago, while the UK remains substantially below pre-pandemic levels.

Source: Bloomberg, US Federal Reserve, Bank of England, 13 February 2023

To be clear, we do not think the US consumer is in bad shape or irresponsibly spending its savings stack at this stage. But it is worth highlighting that part of the reason for lower UK consumption is an abundance of caution from the country’s consumers. As fixed income investors, we tend to be fans of caution.

Financial assets that depend more on growth rates to be at or above trend (equities, for example) are more likely to disappoint in the UK in our view. But for fixed income investors it is definitely not a bad thing for consumers to retain an additional buffer in case the picture deteriorates from here. The more levers consumers have available to pull, the lower the chance of their mortgages or other loans winding up in banks’ non-performing loan books.

Within fixed income itself, at this stage we would be wary of high yield bonds from UK issuers where plans for future deleveraging or free cash flow generation rely heavily on growth. However, we do see reasonable value in UK sectors such as banks, insurance and investment grade credit, despite the growth picture being worse at first glance than other G7 nations.

Stay up to date with our latest blogs and market insights delivered direct to your inbox.