Starved of Income

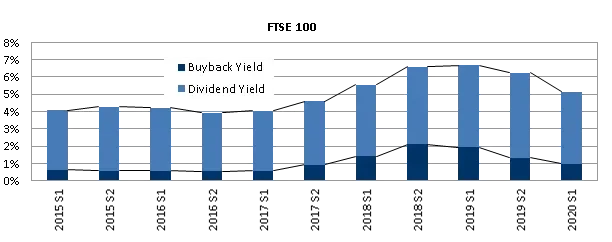

With BP slashing its dividend this week, we have now seen 52 of the FTSE 100 companies suspend or cut their dividends this year. The current Bloomberg projection for the index’s dividend yield is 3.74% vs 4.35% on 31/12/2019 – a significant drop when remembering that the FTSE 100 was 25% higher at the start of the year. The FTSE 250, with less reliance on oil income and more tech stocks, has a slightly smaller proportion of companies announcing a cut or cancellation – currently the total sits at 107. However many FTSE 250 companies never pay a dividend and so its projected yield sits at just 2.51%, down from 2.93% coming into 2020. Equity income investors are becoming increasingly reliant on a small number of healthcare and consumer defensive stocks for dividend payments. Oil and gas majors – traditionally stalwart payers of dividends – are likely to continue disappointing with low commodity prices keeping cashflows under pressure. Alongside this, banks remain forced into a capital retention mode by regulators and they are unlikely to ease on this before the peak in defaults.

Source: Bloomberg

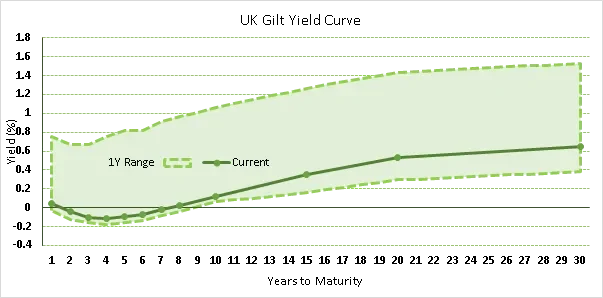

Meanwhile gilt yields are negative out to 8 years, despite the Bank of England highlighting their understanding that negative rates would be detrimental to banks at a time when their financing of individuals and companies is essential for our economy recovery. The maximum yield an investor can earn through UK government bonds currently is a paltry 0.65% – if they are willing to ignore inflation fears and lock their money in a 30 year gilt.

Source: Bloomberg

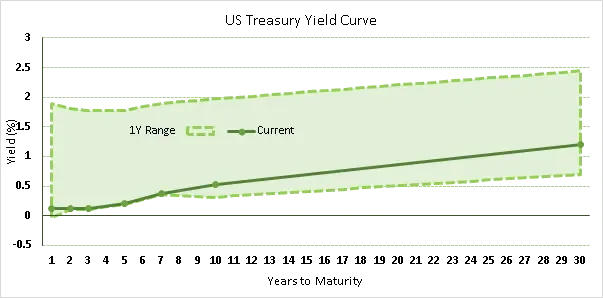

Looking internationally for income also presents slim pickings. The yield on US treasuries is at all-time lows with the US 10 year at 0.53% and US 30 year at 1.20%, whilst the yield on German bunds remains negative across the entire curve. Dividend prospects are similarly dire for equities outside the UK, with Covid-19 causing a global pullback in payments to shareholders.

Source: Bloomberg

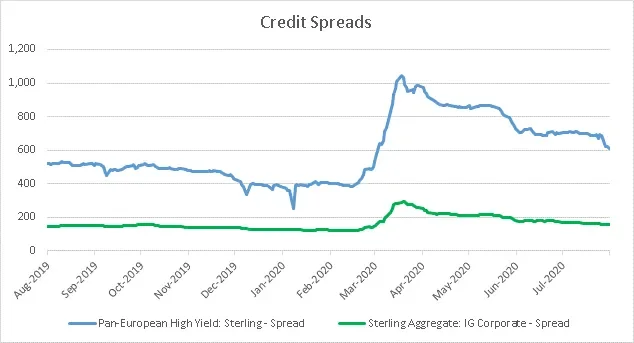

So what relevance does this all have to us as credit investors? Ultimately the trend for income as a scarce commodity continues unabated. Some investors have made capital gains on assets as diverse as treasuries, gold and equities this year and may continue to do so. But those looking for yield are finding their options dwindling. Corporate bonds, both investment grade and high yield, are one of the few remaining sources of income. IG and HY have both recovered a large proportion of the widening witnessed at the peak of the Covid-19 driven sell-off but this strong positive technical is likely to keep grinding spreads tighter. While investment grade bonds are almost fully underwritten by central bank support programmes, high yield assets still have to go through the impending but well-flagged default cycle. However, as investors reach for yield, generally they are squeezed into reaching for risk as well. Unless we see a material change in the risk outlook – and presently company results continue to surprise to the upside while the consensus for the peak default rate is being adjusted down – that weight of money from investors starved of income, should see IG and HY continue to perform.

Source: Bloomberg Barclays Indices