Gilts Go Grizzly

Just two months ago, in Gilts Go Gangbusters, we argued that having long-dated conventional Gilts with cash prices of over 200 was unsustainable in the long term.

How wrong we were – because they weren’t sustainable in the short term either. In the last two months, long-dated Gilts have seen cash prices fall by thirty points or more and the pace of the fall has surprised even ourselves. Far from being only a long term valuation issue, in the short term, and despite buying from the Bank of England, UK risk-free rates are showing they are anything but risk-free.

So what is causing the sell-off? Well, it is tempting to point the finger of blame at the Brexit vote, especially given the substantial fall in the pound that we’ve seen - it would fit the narrative easily wouldn’t it? Mix up some blame over a little bit of confusion around the likely course of fiscal policy in the UK, coupled with the hard/soft Brexit debate, perhaps some more statist interventionist policy hinting from the Tory party conference, with a soupcon of inflationary pressure from the weaker pound, and hey presto, the gilt sell-off is explainable.

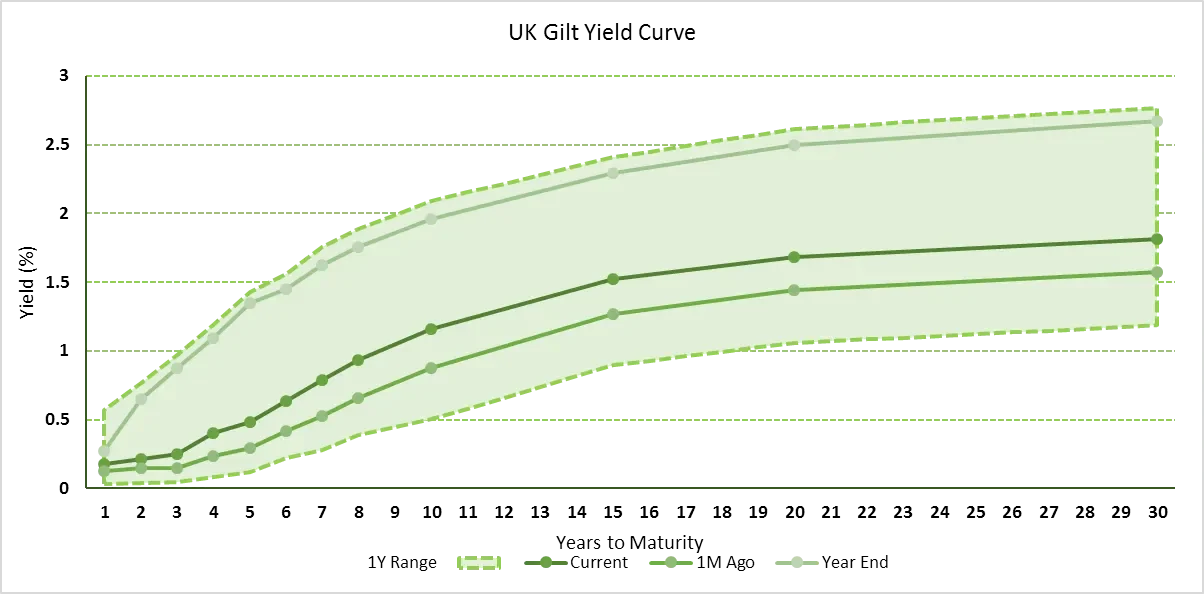

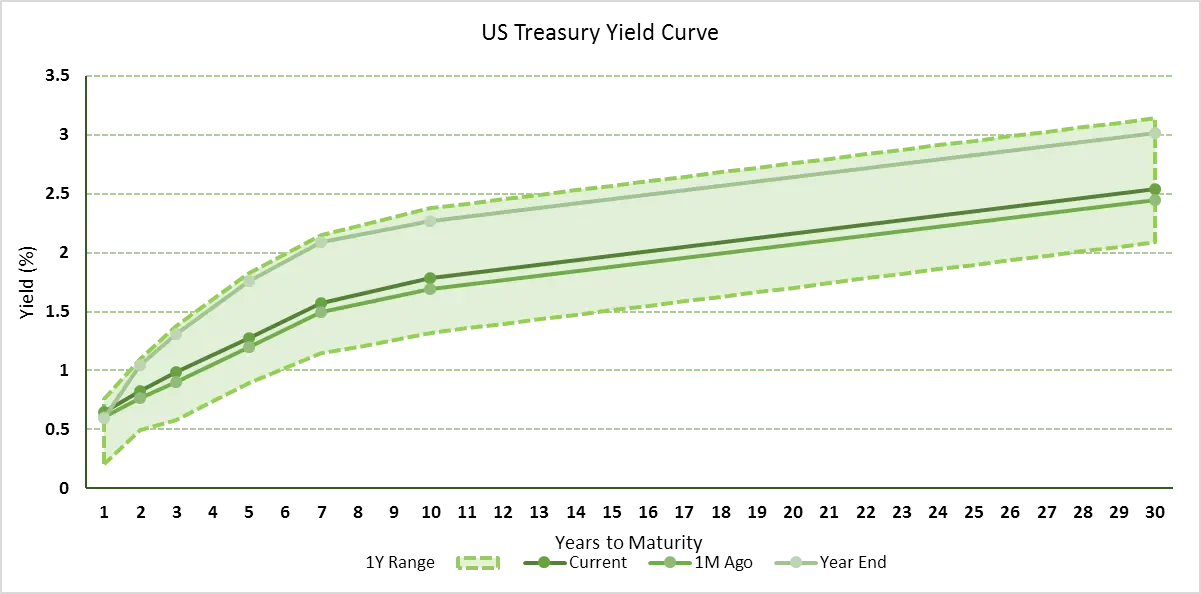

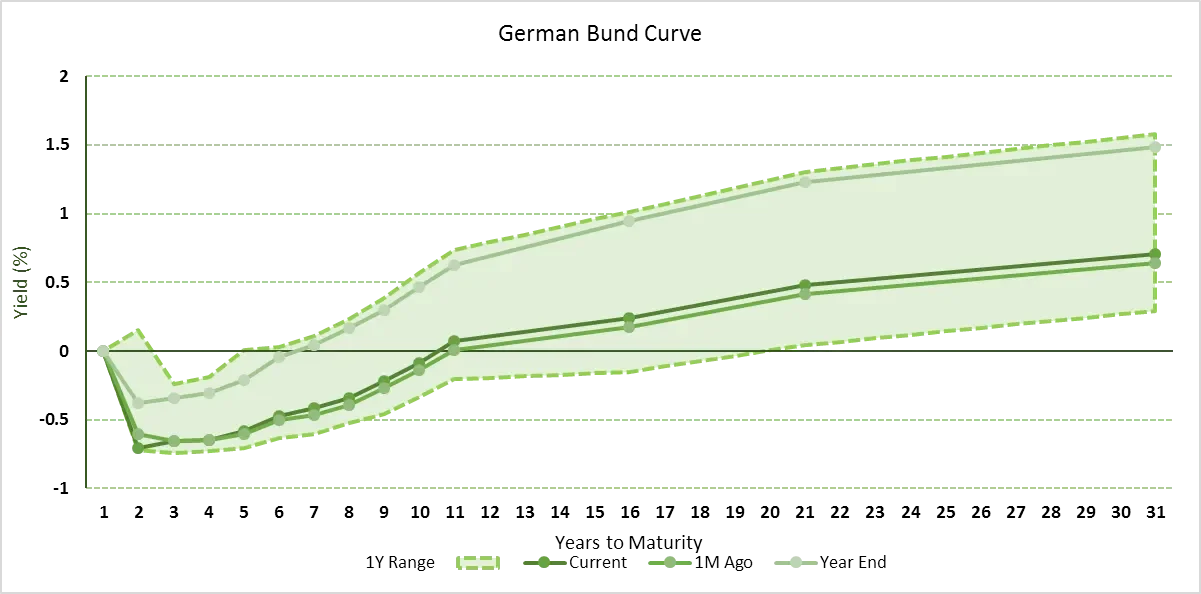

The data however points to a more global trend (all charts from our daily datasheet, as at 17th October 2016).

Looking at the darkest green line above, showing the current UK gilt yield curve, you can see that gilt yields are higher across the curve than one month ago. No surprise there. However, in terms of the last twelve month’s moves, they are almost half-way between the lowest they got to and the highest they got to. You might argue the curve has steepened a tiny bit, however.

But if this was a UK only story, you wouldn’t see a similar picture in the US bond market, right? Wrong. US Treasuries (USTs) are trading almost half way back from their last twelve month tights as well.

And Bunds have moved perhaps 1/3rd of the way back (but have a much bigger Q.E. programme also supporting them).

So it appears there is something else going on here. Yes, Gilts have underperformed USTs to a small extent, and Bunds to a larger extent. But those bond markets have had substantial sell-offs too; and a fair degree of curve steepening has been seen in the Bund curve as well.

A thirty point sell off in risk-free rates in two months, even in a country with an active and substantial Q.E. programme and where inflation has not surprised to the upside, highlights that duration risk remains an ever present risk to capital values. We still see far more value in short and medium dated credit, where durations are lower, yields are far higher, and breakeven protection is so much higher.