CLO metrics remain robust as leveraged loans beat expectations

Recently our credit colleagues wrote about the performance of the high-yield (HY) market and how the maturity wall doesn’t seem to represent a hurdle for most companies . We thought it’s worth highlighting what trends we have seen in the parallel leveraged loan market this year and how that has impacted the performance of CLOs.

On the supply side we have seen a similar trend to the HY market, disappointing figures and record levels of so-called amend and extend (A&E) agreements. The supply of new-issue loans has reached €29bn year-to-date (YTD) versus €35bn in 2022 and €112bn in 2021. LBO and M&A activity, which are the main drivers of issuance, have remained lacklustre through the year due to high funding costs, uncertainty on valuations, and risk-off investor sentiment.

A&Es are maturity amendments, no new loan is created and it’s just an existing loan being extended in exchange for a premium paid. In the past, companies in trouble used this route to stay “alive”, while lately it’s been used by good quality companies. The surge in loan refinancing activity (€33bn YTD versus €2.6bn in 2022) has been absorbed very well by the CLO market and has smoothened the maturity wall considerably.

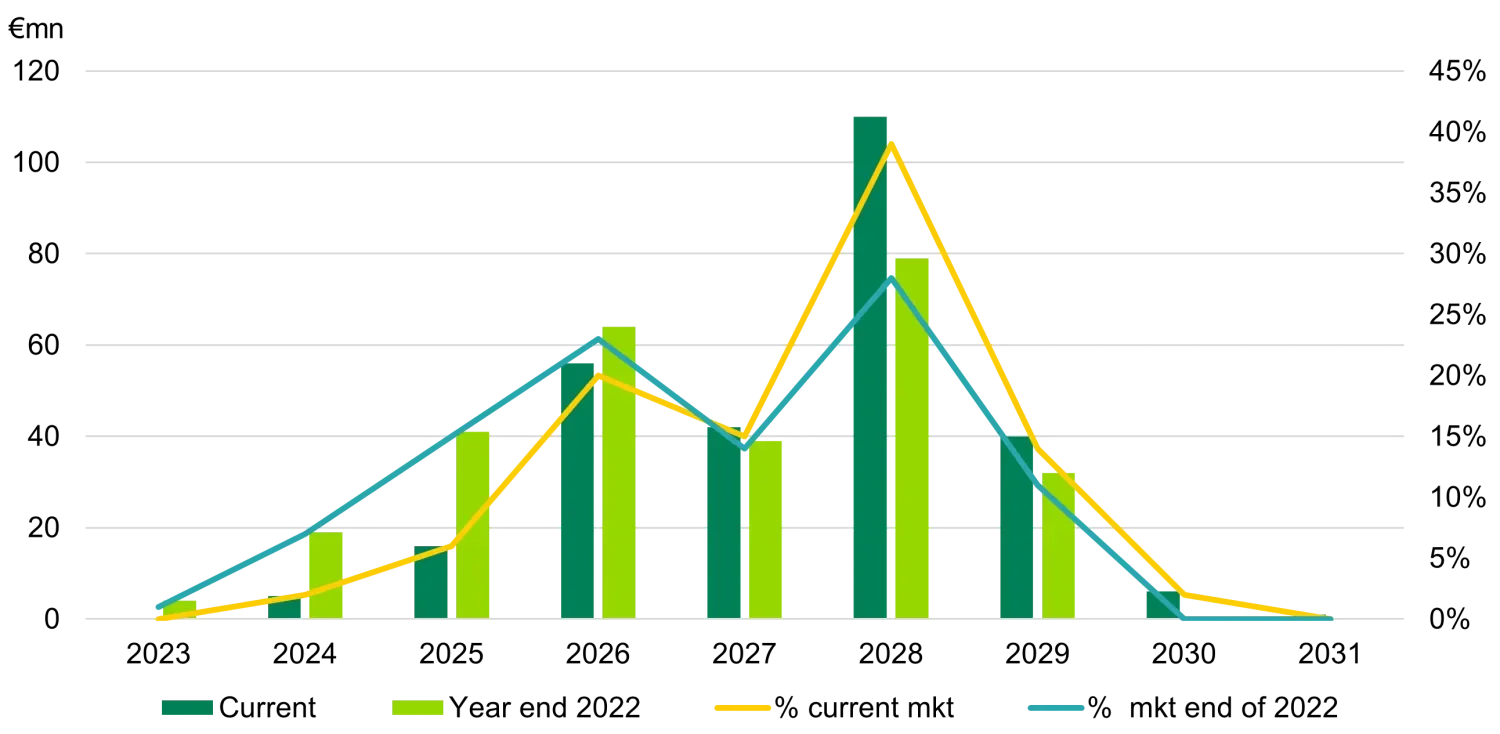

For example, towards the end of last year around 7% and 15% of the ELLI (European Leveraged loan Index) was set to mature in 2024 and 2025, respectively. As of this month those proportions have declined to approximately 2% and 6%, respectively. That is in contrast with 19% of the European HY index maturing in 2025. Currently, over 90% of loan maturities are 2026 or later, which will really help prevent refinancing problems over the coming two years.

Leveraged Loan Maturity Wall

Companies have been proactive in addressing their maturities and sponsors have shown support by injecting new money in some instances. For this reason the spike in default rates that we expected to occur this year hasn’t materialised, which has also been helped by better-than-expected earning results due to a portion of companies having interest hedging in place, a less severe macroeconomic backdrop, and the ability of loan issuers to use the private markets in the case of more difficult refinancing scenarios.

The 12-month default rate has increased to 1.3% from 0.4% in December 2022, in contrast to the 3% forecasted by the majority of banks. If we look at the average defaulted stock in CLOs it remains extremely low at 0.5% (up from 0.3% in January 2023). Clearly there is some tiering across managers, with some having 0% defaulted names and some showing 3%.

Downgrades, however, have increased and are outpacing upgrades, which is not a surprise with Euribor approaching 4%, pushing the cost of debt up. In the third quarter EU Levfin issuers reported EBITDA growth of -11%, while 11% of the ELLI index have been impacted by downgrades so far this year. We expect the increase in rates to continue to hurt corporate earnings next year and the interest coverage ratio to halve, although the lack of imminent maturities and the ample liquidity most corporates are sitting on will help keep defaults lower.

The average CCC bucket in CLOs is currently 3-3.5%, up from the 2% historical average but lower than the 6% reached during Covid. The distress ratio (proportion of assets with a market price below 70) has also remained stable versus a year ago at 2.5%. This represents an important figure as it suggests the loan market is pricing in only a moderate level of defaults.

Finally, we highlight the solid structural protections that CLO bonds offer to investors. In other words, most deals continue to have healthy buffers for losses, which gives us confidence that they should be able to withstand an increase in defaults and downgrades next year.

A growing proportion of deals have stopped reinvesting and have started to pay down, a consequence of this deleverage is that roughly 10% of European CLO tranches have been upgraded since the beginning of the year, while only 0.55% have suffered downgrades. And they were exclusively focused in BB and B tranches from 2017-2019 vintages.

The better-than-expected collateral performance, together with the floating rate nature of the product made CLOs one of the best performing asset classes this year with >15% and > 25% total return on BBBs and BBs. We continue to stress the importance of manager due diligence and collateral analysis as we navigate uncharted territories and macro headwinds next year and we continue to view CLOs as an attractive carry and diversification investment in fixed income portfolios.