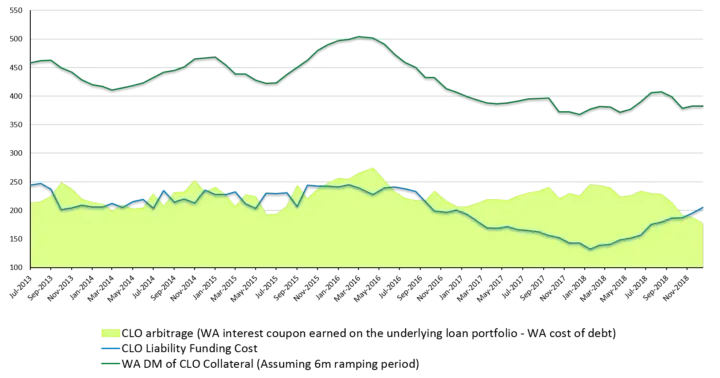

CLO Arbitrage Worst Since 2013

CLO investors like to talk a lot about arbitrage, or rather the lack of it. Arbitrage is what is left of the monthly interest on the leverage loans in the CLO pool once the liabilities have been paid, and it is the main reason why a growing number of investors have been buying CLO equity in the last 18 months.

However, an influx of new equity investors has also squeezed the available spread in CLO transactions. As M&A activity ground to a halt in the second half of 2018, the CLO machine did not, meaning arbitrage has now been reduced to the worst level seen since the rebirth of the CLO sector six years ago.

To put that into context, if the weighted average (WA) spread on the loan pool is 3.70% and the WA liability spread is 2.20%, that leaves 1.5%, which is clearly interesting to investors at 10x leverage. That looks ok, if there were no management fees (typically 0.5% plus performance fees) and if we lived in a zero default world. Neither of these are true, and though investment banks are marketing equity at a projected 1-2% default rate with 30% loss severity in order to get to 10% internal rates of return (IRR), those are very unlikely to be true either. Let’s not forget that leverage loan defaults average at around 3% over longer periods, but peaked at close to 11% in 2010. If we consider a more realistic default level now that we’re getting closer to the end of the credit cycle, taking the IRR after losses and fees to around 6-8% for equity investors, then they would probably be better off buying BBs. Obviously there are very large differences between managers and some add more value than others.

If the previous cycle taught us anything, it’s that CLOs tend to perform rather differently depending on their vintage. This is for a number of reasons including late-cycle lending, leverage, and indeed arbitrage. If we consider the fundamental performance of CLOs today, we can see that overall performance is relatively good. Senior leverage is creeping up, but interest coverage is high and loan-to-values on leveraged buyouts are low. The average rating of underlying collateral is relatively stable and firmly wrapped around the single-B (B2 at Moody’s) level, and the average amount of CCC-rated loans is still well below 2% of CLO portfolios with negligible defaults.

However, we also know that rating agencies tend to be slow with downgrading collateral and that hard default covenants aren’t common for leveraged loans anymore. In addition, looking at the amount of collateral trading below 90 or 80 cash price, we can see a reasonable pick up of what we’d consider “distressed” loans to around 6% (Morgan Stanley, December 2018), levels we last saw in Q1 2016. It is unlikely all of these names will default, but it’s a good indicator of sentiment in the loan market.

With the current lack of arbitrage, and this late in the cycle, caution is warranted. Moving up in the CLO capital structure to BBB or BB rated bonds should help investors once the cycle turns, while still maintaining attractive yield levels (4.5-5% and 7.5-8% in sterling terms, respectively), and leaving room for spreads to tighten in the short to medium term, if supply remains light. Similarly, single-Bs at 10-12% in GBP, for the right managers and healthy pools, seem a good alternative for equity investors and funds that can deal with the lower liquidity.