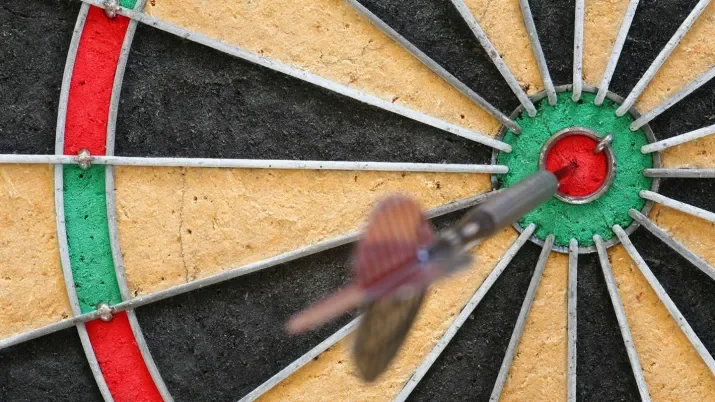

August cut hopes fade despite BoE’s inflation bullseye

The latest UK inflation figures will bring some relief for consumers, but beneath the headline figure the Bank of England’s (BoE) policymakers face a more complex picture that suggests interest rate cuts may still be some way off.