TwentyFour Asset Management LLP (“TwentyFour”, the “Firm”) is committed to responsible environmental practices and operating in a sustainable manner.

The Firm monitors all corporate travel, seeking to minimise unnecessary trips and supporting this with investment in video conferencing capability as well as greater use of webcasts and video content for client engagement. TwentyFour’s support of the Cycle to Work Scheme, as well as the provision of secure cycle parking and changing facilities further promotes greener commuting.

Carbon Neutrality

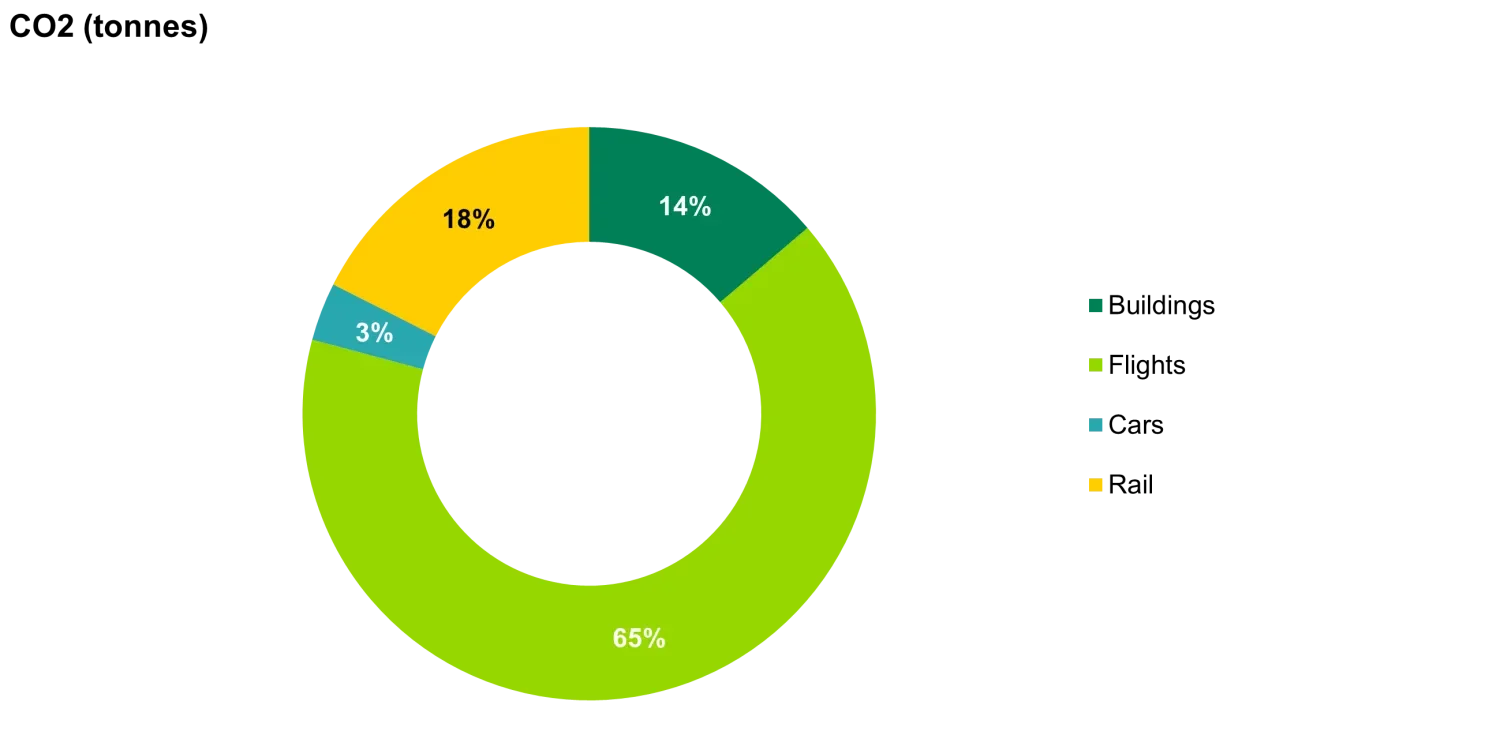

Surveying staff commutes, corporate travel and building energy usage, TwentyFour has identified its total carbon emissions to be 186.9 tonnes CO₂ emissions per annum. This equates to a carbon intensity of 3.1 tonnes per employee (at the lower end of the range for an office based organisation).

Source: TwentyFour Asset Management

TwentyFour feels it is important to achieve a carbon neutral position and has achieved this by offsetting these emissions with an investment in a PAS 2060 Carbon Neutrality Offset Project.

Reduce & Recycle

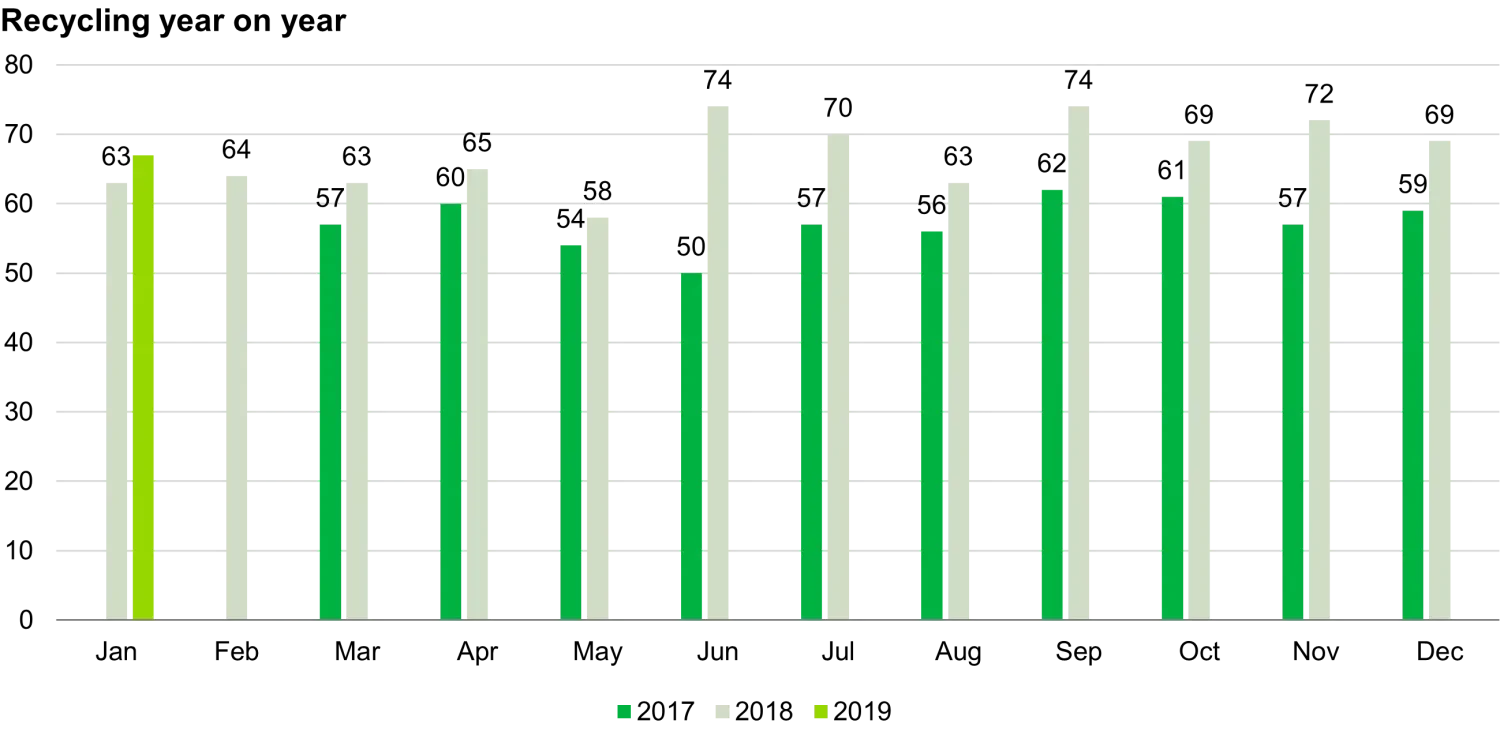

TwentyFour works with its building management to track and reduce landfill waste. Recycling levels are tracked monthly with the aim of recycling over 95% of the office’s waste products, currently achieving 67%. TwentyFour is pleased to operate from premises which meet the BREEAM excellent environment standard with a green roof, solar panels and an intelligent lighting control system.

Source: TwentyFour Asset Management

A core tenet of our invest philosophy is that “diversity of experience ensures a wide range of views to capture returns and mitigate risks”. TwentyFour thus seeks to attract and promote a diverse workforce. Our long term focus is a competitive advantage and encourages an emphasis on retaining and developing our staff, offering benefits and policies which support their wellbeing, career development and promote equality across the Firm.

Operating in a dynamic marketplace it is essential we continually update our skills and knowledge. TwentyFour provides regular internal training to help achieve this, keeping employee engagement and satisfaction high. Staff across the organisation also have the opportunity to attend external training courses to support their work. The Firm invests in its human capital by encouraging staff to take professional qualifications, paying for tutoring and materials as well as providing time off for study.

TwentyFour recognises the importance of work-life balance and seeks to build a culture to support this. The Firm offers benefits that are enhanced above statutory requirements for both maternal and paternal leave. By doing this, TwentyFour seeks to encourage all forms of parental leave and help support the careers of our own staff and their partners. Staff are able to keep in touch over the course of their leave and are assisted in their return.

TwentyFour appreciates the gains both to individual staff and the Firm that come from flexible working practices and we are committed to supporting, wherever possible, a flexible work environment for our employees. Our flexible working policy gives eligible employees an opportunity to formally request a change to their working pattern. No-one who makes a request for flexible working will be subjected to any detriment or lose any career development opportunities as a result. Flexible working can take several forms including: a reduction or variation in working hours; reduction of the number of days worked each week; and/or working from a different location (for example, from home).

TwentyFour is committed to ensuring that all employees and workers are treated fairly, and with dignity and respect. It is TwentyFour’s policy that no employee should be treated less favourably on the grounds of sex, race, nationality, marital or civil partnership status, religion or belief, sexual orientation, gender reassignment, pregnancy/maternity, disability, age, or any other grounds. This policy applies to recruitment, promotion, training, placement, transfer, dismissal as well as remuneration, grievance and disciplinary procedures and decisions. This policy also applies to workers (who are not employees) and to the treatment of contract workers. Whether discrimination is direct, indirect or takes the form of harassment or victimisation it is unacceptable. TwentyFour will recruit employees and make other employment decisions concerning promotion, training, dismissal etc. on the basis of objective criteria.

In-Kind Initiatives

TwentyFour acknowledges the community at large as one of its stakeholders and seeks to make a positive impact beyond its investing activities. The Firm places an emphasis on in-kind support, and our staff are keen to put their skills to work directly benefiting the wider community.

One of the major challenges in the financial industry is the disproportionately low representation of women in senior positions. While we acknowledge that the cause of this is complex and multivariate we believe that a major contributory factor is that historically the financial industry has both not appealed to female candidates as a career choice nor done enough to encourage participation. Consequently the pool of women in our industry does not reflect society as a whole.

There are no easy short cuts to what is a time horizon problem. At TwentyFour we are proud to have teamed up with Queen Mary University of London’s (QMUL) mentoring scheme with the aim of specifically providing female undergraduates less familiar with the workings of the City with advice, guidance and encouragement.

There are several additional reasons why the QMUL QMentor scheme is a natural fit for our Firm. Firstly, it is our closest neighbouring University, being situated in Tower Hamlets just east of the City. Secondly, 90% of its undergraduate intake derive from state schools, a significant number from the local area. Finally, QMUL has an extensive bursary scheme aimed at supporting the brightest and best students from less privileged backgrounds.

We participate in a rolling mentoring programme and are exploring other avenues with the University to help increase students’ understanding of the opportunities working in the City presents.

Should anyone in our industry wish to explore QMUL QMentoring for themselves or their firm you can learn more using the following link, https://profdev.qmul.ac.uk/what-we-offer-/coaching-and-mentoring/

or contact l.chastney@qmul.ac.uk

Community – Direct Giving

We also support a number of charities through direct donations. Recognising that charitable giving is very personal and most successful when that passion is harnessed, we are led by our staff’s choices of which causes to support. We regularly run staff events to generate funds for the specific causes, rotating through those that have been championed by our people.

TwentyFour supports its staff in fund-raising for individual charities by matching any sums raised, thereby doubling the amount raised by staff for their chosen charity and encouraging greater levels of charitable endeavour.

Strong corporate governance is essential for TwentyFour to continue serving its customers and other stakeholders to the very highest standard while accurately identifying, reducing and mitigating financial and non-financial risks. TwentyFour is structured through a series of committees and steering groups with appropriate levels of independence to ensure our mission is translated into effective strategies and these are implemented as expected.

Committees

Executive Committee

Made up of the Chairman, CEO, COO and a founding partner – TwentyFour’s Executive Committee is responsible for the day-to-day management of the firm and has over 120 years combined experience from investment banking, asset management and legal backgrounds.

Risk & Compliance Committee

Made up of the Chief Risk Officer, Chief Compliance Officer and Head of Operations – the Committee is responsible for oversight of the Risk Management Framework of the Firm and specifically the effectiveness of risk management and compliance activity within the Firm.

Investment Committee

Day-to-day portfolio management is the responsibility of the portfolio management team, which is drawn from both trading and portfolio management backgrounds.

Product Governance Committee

Chaired by the Deputy COO and made up of representatives of the Executive Committee, Compliance, Legal and Transaction Management and Risk, the Committee assists the Executive Committee to meet product governance requirements and to ensure that the products and services TwentyFour offers are in the best interest of the Firm’s clients.

Legal & Regulatory Committee

Made up of the Chief Operating Officer, Chief Compliance Officer and Legal and Transaction Management, the Committee’s responsibilities include monitoring new legislation and regulation, assessing the impact of these on TwentyFour and, if required, implementing such legal and regulatory changes.

Counterparty Review Committee

Made up of the Chief Risk Officer and Chief Compliance Officer, the Risk and Compliance teams are responsible for the due diligence before on-boarding and subsequent daily monitoring of all trading counterparties.

Steering Groups

Environmental Social Governance Steering Group

The ESG steering group is led by TwentyFour’s Chairman and contains representatives from across the Firm. It meets to determine our ESG goals and methodology – both internally and with regards to our investment policy. The group helps ensure its strategies are effectively implemented across the Firm.

Information Technology Steering Group

The IT steering group led by Operations with representatives from Risk, Portfolio Management, and Compliance ensures TwentyFour is making most effective use of its information technology resources, efficiently and responsibly handling data while identifying risks in its processes.

Standards

GIPS

Global Investment Performance Standards (GIPS) are a set of voluntary standards used by investment managers throughout the world to ensure the full disclosure and fair representation of their investment performance. TwentyFour is GIPS compliant and fully committed to remaining so.

ISAE3402

TwentyFour has achieved the ISAE3402 assurance standard on its Internal Control Framework over Financial Reporting. This standard documents that TwentyFour has adequate internal controls from a financial reporting perspective.

Policies

Below are summary descriptions of some of TwentyFour’s relevant governance policies.

Modern Slavery

Modern slavery is a crime and a violation of fundamental human rights. It takes various forms, such as slavery, servitude, forced and compulsory labour and human trafficking, all of which have in common the deprivation of a person’s liberty by another in order to exploit them for personal or commercial gain.

It is TwentyFour’s policy not to tolerate slavery and human trafficking practices within our business and supply chains. TwentyFour will take appropriate and reasonable measures to minimise the risk of this taking place in line with the nature of services provided to either Firm.

Human Rights

TwentyFour is committed to respecting international standards for human rights with policies and processes in place to identify and prevent human rights risks. TwentyFour relies on a supply chain of third parties to deliver services, who we expect to operate in an ethical, open and transparent way. As an asset management firm with relatively simple supply chains predominantly comprising business and professional services organisations, we believe that there is limited risk of human rights violations taking place. We undertake due diligence and ongoing monitoring of all suppliers, to include confirmation of compliance with relevant laws and regulations.

Diversity & Inclusion

TwentyFour is committed to ensuring that all employees and workers are treated fairly and with dignity and respect. It is TwentyFour’s policy that no employee should be treated less favourably on the grounds of sex, race, nationality, marital or civil partnership status, religion or belief, sexual orientation, gender reassignment, pregnancy/maternity, disability, age, or any other ground on which it is or becomes unlawful to discriminate under the laws of England and Wales (each one being a “protected characteristic” under this policy). This policy applies to recruitment, promotion, training, placement, transfer, dismissal as well as remuneration, grievance and disciplinary procedures and decisions. This policy also applies to workers (who are not employees) and to the treatment of contract workers.

Cyber Security and Data

TwentyFour recognises the need for vigilance in protecting its IT infrastructure, the Firm and its clients’ data. We have a thorough Cyber Security Policy to inform Firm users: employees, contractors and other authorised users of their obligatory requirements for protecting the technology and information assets of the Firm. The Cyber Security Policy describes the technology and information assets that must be protected and identifies many of the threats to those assets.

The Firm also has a comprehensive set of policies on the data it collects, how it is stored, processed and shared. We respect the privacy rights of individuals and are committed to handling personal information responsibly and in accordance with applicable law.

Anti-Financial Crime

TwentyFour recognises that financial crime in all its forms is a threat to the Firm, its subsidiaries and the financial services community. TwentyFour is committed to the prevention of financial crime such as money laundering, the funding of terrorist activity, bribery and corruption, fraud and market abuse and through risk-based internal procedures, policies and systems and controls strives to ensure that high standards of crime prevention and awareness are maintained by all Partners, Directors, employees and consultants, whether under a contract of employment or a contract of service or otherwise. Through our financial crime policies and procedures we aim to prevent, deter, detect and investigate all forms of financial crime.

Graeme Anderson

Chairman

Nick Knight-Evans

COO