What Does US Loan Underperformance Mean for Bondholders?

There have been some interesting developments in the US leveraged loan and CLO markets recently, and though we generally prefer European CLOs, given how correlated the markets are we obviously keep a close eye on what happens on the other side of the pond. The European CLO market is much smaller, but given the US is further ahead in the economic cycle, the US market can provide a good indication of what might happen in Europe.

US loan prices have recently started to underperform compared to Europe, for two clear reasons. Firstly investors have pulled money out of open-ended loan funds, to the tune of $42bn in the last 12 months according to the FT. Leveraged loans are a floating rate product, and with rates going down rather than up in the US, many investors have started selling loans in favour of fixed rate bonds. But secondly, and more importantly, the number of distressed loans has picked up dramatically in recent months as earnings have disappointed. On top of this, the rating agencies have put a large number of loans on ‘negative outlook’, and with the majority of these rated B2 and B3, in many cases a downgrade into CCC territory looks inevitable.

According to Moody’s Analytics, CCCs in CLOs have increased to 5.5% in the US and 2.5% in Europe, still significantly below levels seen during the last recession (when levels of 15-20% were “normal”), but nevertheless they have increased in recent months. The absolute level of CCCs is not particularly interesting to us, but the number of B3 rated assets on negative outlook is. By design, CLOs can deal with CCC assets and loan defaults. CLOs have structural features such as risk-adjusted par value coverage tests (designed to ensure bondholders have enough subordination when performance slips), which protect more senior bondholders at the expense of equity and junior investors.

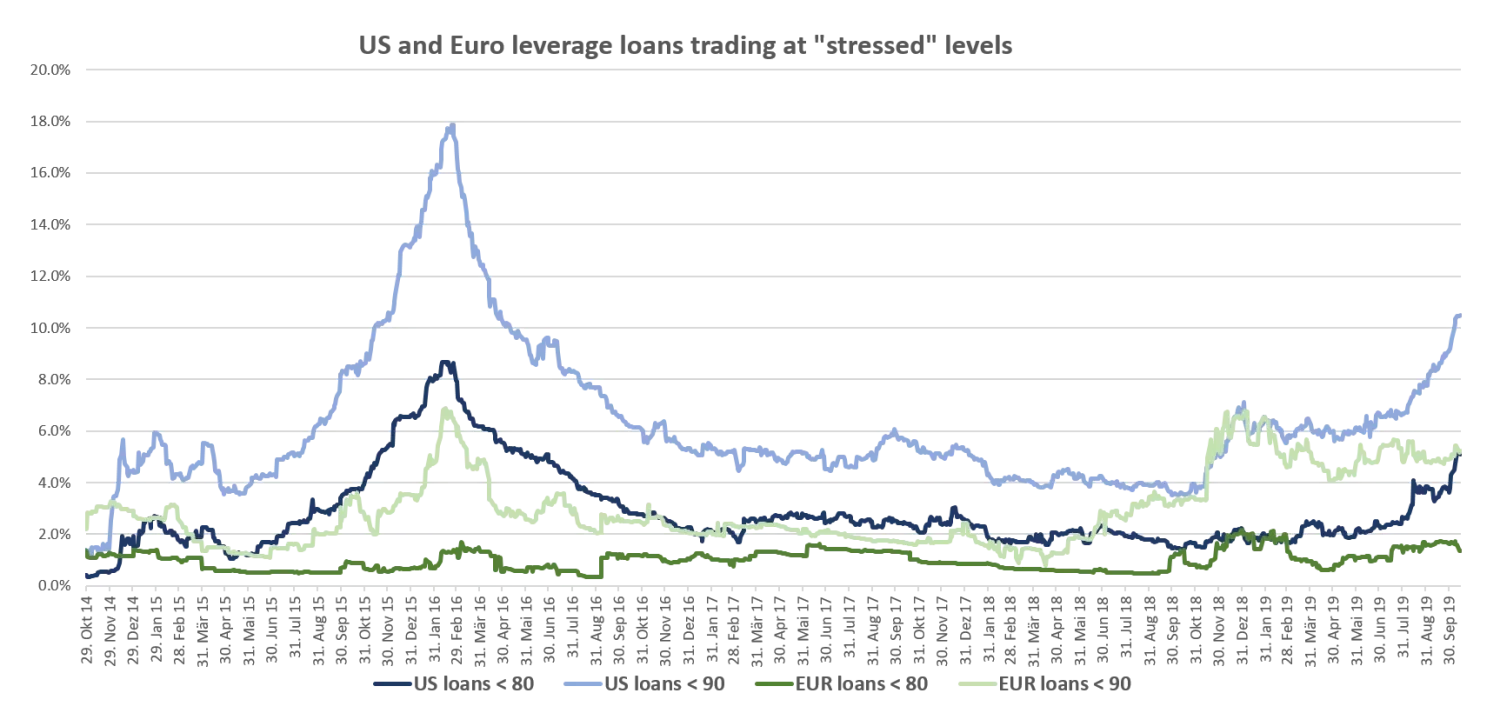

By the end of the third quarter of this year, Moody’s had 194 US loan obligors’ ratings on negative outlook, compared to 110 at the end of Q1. According to Citi, US CLOs have an average exposure of 6.5% to these loans, but with a range of 2.8% to 15.4%, so we would expect to see even more performance tiering between managers and vintages from here. One thing that we monitor closely is the number of loans that trade below a cash price of 80, as this typically indicates there is something wrong and a restructuring could be required. The number of these ‘stressed’ loans has increased rapidly in recent months to around 5% in the US. The pipeline of loans that we can potentially classify as stressed has also increased, but this can also indicate CLO managers selling assets threatened with a potential downgrade or simply taking a view on different sectors (like we saw in the end of 2015 and early 2016 with loans exposed to the Oil & Gas sector).

Source: Moody’s Analytics, October 28, 2019

When we speak to US CLO managers and traders it doesn’t sound like there is a clear sector that is underperforming like in 2015, but that there are more idiosyncratic stories. How many of those do we need to say the market is slowing down? Recent performance is a clear indication to us that the cycle is maturing in the US. Europe looks to be in better shape, but at some stage it is likely to follow the US and European loan downgrades will also pick up. However, as long as interest rates remain at all-time lows many CFOs will probably be able to keep their businesses going for a little bit longer as interest coverage remains healthy.

What does this mean for CLOs? It will very much depend on the manager of the CLO, as some managers run fairly liquid portfolios and can aim to add alpha in periods when markets are weak. Fund managers that are facing redemptions and are forced to sell good quality assets are, perversely enough, the ideal source of collateral for CLO managers with cash to spend, from which both equity and debt investors can benefit.

CLO investors have had an interesting ride of late, and though investment grade rated bonds have held up fairly well, sub-IG is a different story. After a strong start to the year, BB spreads in the US have widened by around 150-175bp since the summer (+100bp year-on-year) and European BBs have widened in sympathy by around 100bp (+20bp yoy). Single Bs are far less liquid and trade sporadically at the moment, but currently yield more than the equity tranches (in the region of Libor +12% in the US and +10% in Europe). With year-end around the corner and a potentially heavy primary market pipeline, we think some deals will struggle to be priced. At Libor +7-8%, European BBs look attractive against comparable US deals given the macro backdrop, and selective single Bs could be interesting for investors that favour lower liquidity.